Imagine that you and your friend own a grocery store together. The place was found by you, the supplies were arranged, and everything was set up by you. Your friend invested some money and worked at the counter.

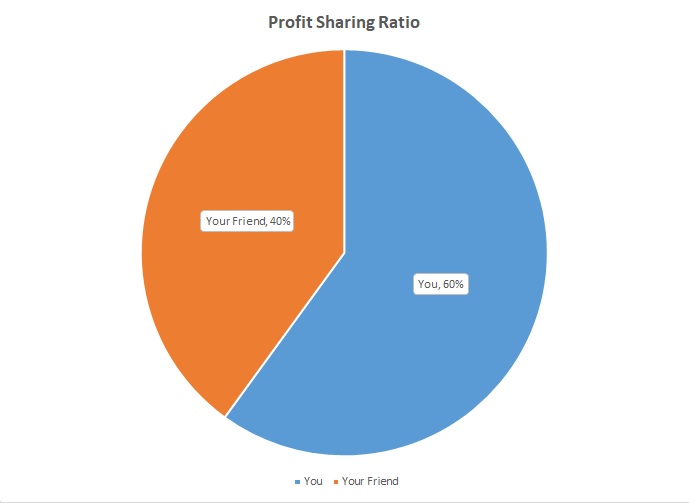

Both of you agree that since you worked harder, you should get more money from the store’s profits. You and your friend decide you’ll get 60%, and your friend will get 40%.

This is your profit-sharing ratio: 60:40. It means that for every 100 the store makes, you get 60, and your friend gets 40.

Table of Contents

Definition

A partnership business is a type of business structure where two or more people come together to start a business. In a partnership, each person contributes resources like money, assets, skills, etc.

The profit-sharing ratio refers to the ratio in which the profits and losses of the business are distributed among the partners. It is determined under a written agreement known as the partnership deed which is prepared as per the terms agreed upon by the partners.

Normally, the partnership deed specifies the split percentage on which the partners will bear losses or distribute profits. However, in some cases, the ratio may differ for the distribution of losses.

However, in the absence of any information in the partnership deed about the profit-sharing ratio, the partners are assumed to be sharing the profits and losses equally.

Related Topic – What is the reconstitution of a partnership?

Factors Affecting the PSR

There are a lot of factors depending on which the partners decide upon this ratio. Some of them are mentioned below:

- Sharing profits on the basis of the effort and skills each partner brings into the business is a common practice.

- Division on the basis of responsibility taken, i.e. the ratio may be based on the role of each partner in the business.

- In some cases, the profit-sharing ratio may be based on the past performance of each partner in the business.

- On the basis of capital contribution, i.e. the partner who contributes a greater share of capital earns a greater percentage of profits, or

- Division on the basis of consideration of both the above-mentioned factors, or

- Any such clause or terms as the partners may agree upon.

Related Topic – Meaning and Methods of Valuation of Goodwill

Calculation & Formula

Ideally, there is no need to calculate the profit-sharing ratio as the ratio is mentioned in the partnership deed, and if no partnership agreement exists, then the profits are deemed to be equally divided between the partners.

However, there can be a few cases under which we calculate the ratio. The cases are mentioned below :

Case 1: If two partners, Y and Z, invest amounts of 100 and 200, and the partners decide to share the profits in the ratio of the amounts invested. Calculate the new profit-sharing ratio.

Y:Z = 100:200

Y:Z = 1:2

| Profit-sharing ratio = Ratio of Invested capital |

Case 2: If two partners, E & F, each invest an amount of 100 for a period of 12 months and an amount of 200 for a period of 12 months, and they decide to share the profits in the ratio of amount multiplied by the period for which such amount is invested. The profit-sharing here would be,

E:F = 100*12/12 : 200*12/12

E:F = 1:2

(Note: The time weights shall be taken in common units of measurement)

| Profit-sharing ratio = Ratio of capital invested*Period of investment |

Related Topic – What is Realisation Account in a Partnership?

Example of Profit Sharing Ratio

A, B, and C decide to start a business together. They form a partnership firm and introduce capital as 40,000, 30,000, and 20,000, respectively. They further decided to share profits and losses in the ratio of their capital. Thus their profit-sharing ratio is calculated as follows:

| Particulars | A | B | C |

| Capitals | 40,000 | 30,000 | 20,000 |

| Ratio | 4 | 3 | 2 |

The profit-sharing ratio will be 4:3:2

Related Topic – 100 Most Important Accounting Terms for Interviews

New and Old Profit Sharing Ratio

There could be several reasons that necessitate a change in the profit-sharing ratios in a partnership. Here are a few: Such change in profit sharing ratio is the consequence of events such as:

- Change in capital contribution

- Admission of a partner

- Retirement of a partner

- Death of a partner

- Mutual consent among the partners

The new profit-sharing ratio is the ratio in which the partners will divide the future profits and losses of the firm. The current percentage split becomes the old profit-sharing ratio.

The old profit-sharing ratio might be the initial agreement or the result of a previous reconstitution as agreed upon by the partners.

Example of Old and New Profit Sharing Ratios

Old Profit Sharing Ratio

Consider two partners, A and B, who run a business together. Their existing (old) profit-sharing ratio is 1:2. This means for every 3 units of profit, A receives 1 unit and B gets 2 units.

Introduction of New Partner and New Profit Sharing Ratio

Now, they have decided to bring in a new partner, C, to help expand the business. They all agree that the profit will now be shared equally among the three of them.

So, the new profit-sharing ratio between A, B, and C will be 1:1:1. This means for every 3 units of profit, each partner (A, B, and C) will receive 1 unit.

Related Topic – What is Revaluation Account in a Partnership?

Sacrificing Ratio and Gaining Ratio

Gaining Ratio: is the ratio in which one or more partners gain a share of profit. It is generally calculated at the time of retirement or death of an existing partner as the outgoing partners lose their share of profit, and hence the remaining partners gain that. The formula for calculation is:

| Gaining Ratio = New Profit Sharing Ratio – Old Profit Sharing Ratio |

Example: X, Y, and Z are partners sharing profits and losses in the ratio of 4:3:2. Partner X retires. Therefore, Y and Z decide to share the profits and losses in the future at 5:4. Calculate their gaining ratio.

| Y | Z | |

| Old Ratio | 3/9 | 2/9 |

| New Ratio | 5/9 | 4/9 |

| Gaining ratio (New – Old) | 2/9 | 2/9 |

In the given case, partners Y and Z each have gained 2/9th of the share of profits due to the retirement of partner X.

Sacrificing ratio: is the ratio in which partners of a firm forego their share of profits. It usually comes into play at the time of admission of a new partner as the old partners sacrifice a part of their current share in favour of the incoming partner.

Such sacrificing partners are compensated by the gaining partner(s) in the form of goodwill. The formula for the calculation of sacrificing ratio is,

| Sacrificing Ratio = Old Ratio – New Ratio |

Example: A, B, and C are partners sharing profits and losses in the ratio of 5:3:2. A new partner, “D”, is admitted to the firm, and the new sharing ratio is 4:3:1:2. Calculate the sacrificing ratio.

| A | B | C | |

| Old Ratio | 5/10 | 3/10 | 2/10 |

| New Ratio | 4/10 | 3/10 | 1/10 |

| Sacrificing Ratio (Old-New) | 1/10 | 0 | 1/10 |

Hence, in the given case, partners A & C have sacrificed 1/10th share of profit each for the new partner. Partner B loses nothing.

| Gaining Ratio | Sacrificing Ratio |

|---|---|

| 1. This is the portion of profit sharing that each partner receives when the profit-sharing ratio changes due to admission, retirement, or death. | 1. It represents how much each existing partner has given up or sacrificed to accommodate a new partner or adjust for a partnership agreement change. |

| 2. New Ratio – Old Ratio | 2. Old Ratio – New Ratio |

| 3. Analyze the profit share gained by each partner. | 3. Calculate how much profit share each partner has given up. |

| 4. Increase in a partner’s share of profit. | 4. A decrease in a partner’s profit share. |

All these ratios are essential tools for managing a partnership. They ensure that all partners are treated fairly and understand exactly what portion of the profits (or losses) they are entitled to and what they stand to gain or lose when changes are made to the partnership structure.

>Read Realisation Account Vs Revaluation Account