Table of Contents

Introduction

Assets include a wide range of things, both tangible and intangible. They can be things like cash, accounts receivable, furniture, machinery, patents, logos, and even social media accounts. An asset is anything of value that a company or person owns to achieve their goals.

Fixed Assets are typically tangible assets like physical items or property owned. They are acquired for a long period with the purpose of carrying out long-term business. In addition to being called property, plant, and equipment (PP&E), they are not intended for sale.

Intangible Assets are assets that can not be physically seen or touched. They can be viewed as certain rights, advantages, or beneficial situations. A few examples would be goodwill, patents, trademarks, copyrights, etc.

It is important to note that fixed and intangible assets can both be long-term and provide ongoing value to an organization.

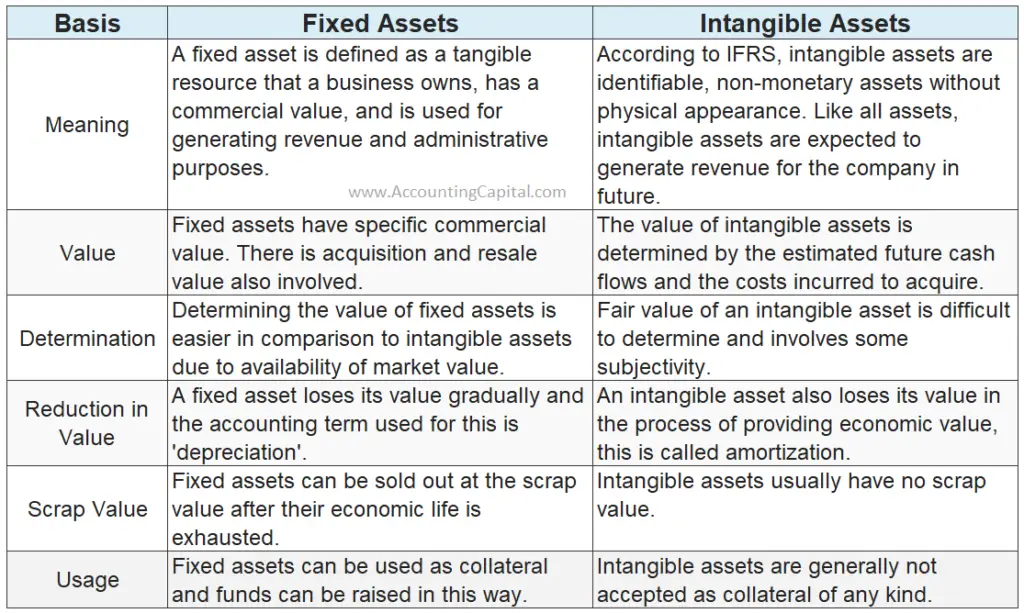

Fixed Assets Vs Intangible Assets (Table Format)

This section discusses the fundamental differences between fixed assets and intangible assets, their characteristics, examples, and their vital roles in a company’s balance sheet.

Related Topic – Quiz on Fixed Assets

Fixed Assets

A fixed asset is a long-term tangible asset that a business holds for production, rental income, or administration. These assets are expected to last more than one accounting period and aren’t resold.

Properties of Fixed Assets

- They provide ongoing benefits across multiple accounting periods and are acquired for long-term use.

- The cost of fixed assets is allocated over their estimated useful lives via depreciation.

- The historical cost of an asset is initially recorded on the balance sheet, which includes all expenses associated with acquiring and preparing it.

- The book value of a fixed asset is its historical cost minus accumulated depreciation, reflecting its net carrying value.

- The fixed assets of a company are investments it makes to support its operations and generate revenue.

- It’s a regular thing for companies to assess the carrying value of fixed assets for impairments.

- A fixed asset must be physical and available to the business. They cannot be paper assets.

- In their financial statements, companies are required to disclose the nature of their fixed assets, how they’re depreciated, and how long they’re going to last.

Related Topic – Quiz on Current Assets

Fixed Assets in Financial Statements

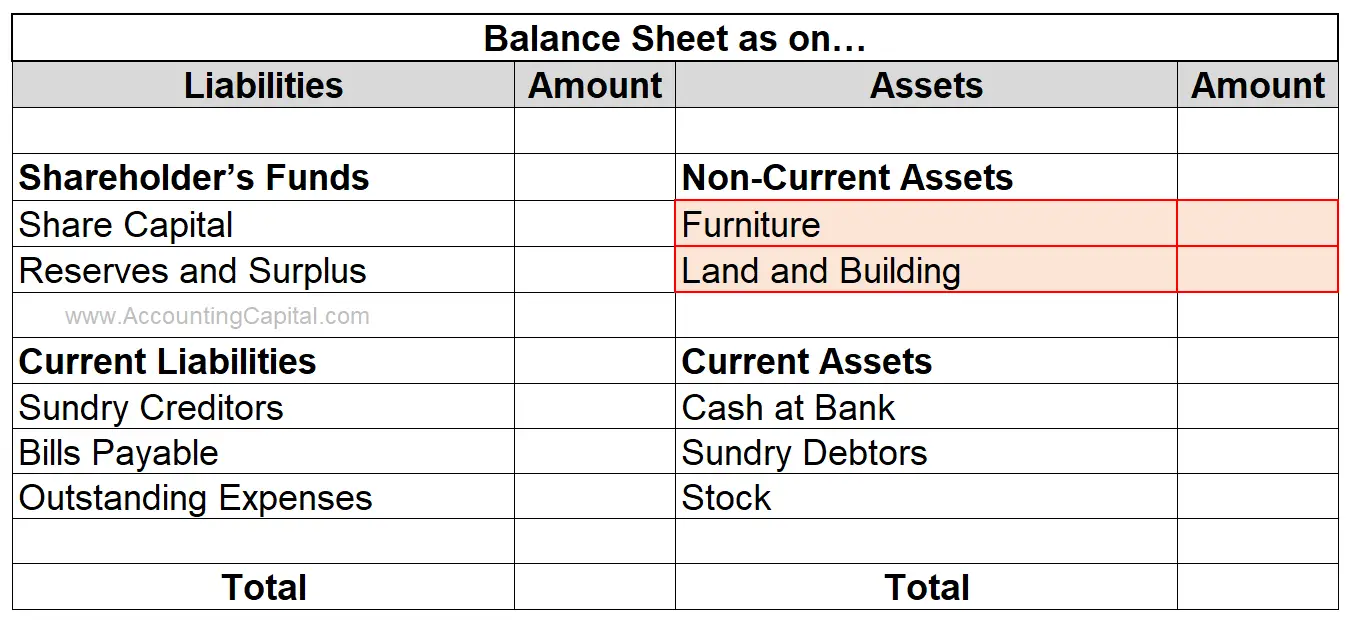

The horizontal balance sheet shows fixed assets at their book value on the ‘Assets’ side (right).  Related Topic – Is Investment an Asset?

Related Topic – Is Investment an Asset?

Examples of Fixed Assets

Some uncommon examples of fixed assets are aircraft for an airline, broadcasting towers for a media company, network towers for a telecom company, data centres, etc.

More common examples

- Land

- Land improvement (e.g. irrigation)

- Building

- Machinery

- Vehicles

- Furniture

- Office equipment

- Leasehold improvements (e.g. air conditioning), etc.

Related Topic – Quiz on Intangible Assets

Accounting for Fixed Assets

Journal Entry to Record Fixed Asset

An example of a journal entry to record the acquisition of a fixed asset, such as a vehicle.

ABC Ltd. purchased a new vehicle worth 50,000 for their business.

| Vehicle A/C | 50,000 |

| To Bank A/C | 50,000 |

Explanation:

The company purchased a vehicle, which is considered a fixed asset.

- The vehicle account is debited with the cost of the vehicle, which in this case is 50,000. This represents an increase in the assets.

- The bank account is credited with the same amount, 50,000 as it was paid by a cheque. This reflects a decrease in the bank balance.

They are usually shown under the head “Property, Plant, and Equipment” (PP&E).

Related Topic – Current Assets vs Liquid Assets

Intangible Assets

The intangible assets of a company are valuable items that do not have a physical existence and cannot be touched.

Properties of Intangible Assets

- Intangible assets are non-physical assets, meaning they lack a tangible form or physical substance. They can exist as ideas, rights, contracts, or legal claims.

- It’s typical to amortize (spread out) intangible assets over their estimated useful lives, making them worth less on the balance sheet over time.

- They’re recorded in the financial statements at their net value, i.e. the gross value of the asset less accumulated amortization.

- It’s important that intangible assets can be separated from goodwill. This allows you to determine their value.

- Intangible assets are also regularly assessed for impairment by companies.

- They may have a life that is definite or indefinite. A patent is a finite intangible asset, as patents are issued for a definite period of time and have to be renewed; however, a company’s brand name will remain over time till the company is in existence.

- Intangible assets can be self-created (loyalty), acquired separately (trademark), and acquired in a business combination (goodwill).

Related Topic – Current Assets vs Current Liabilities

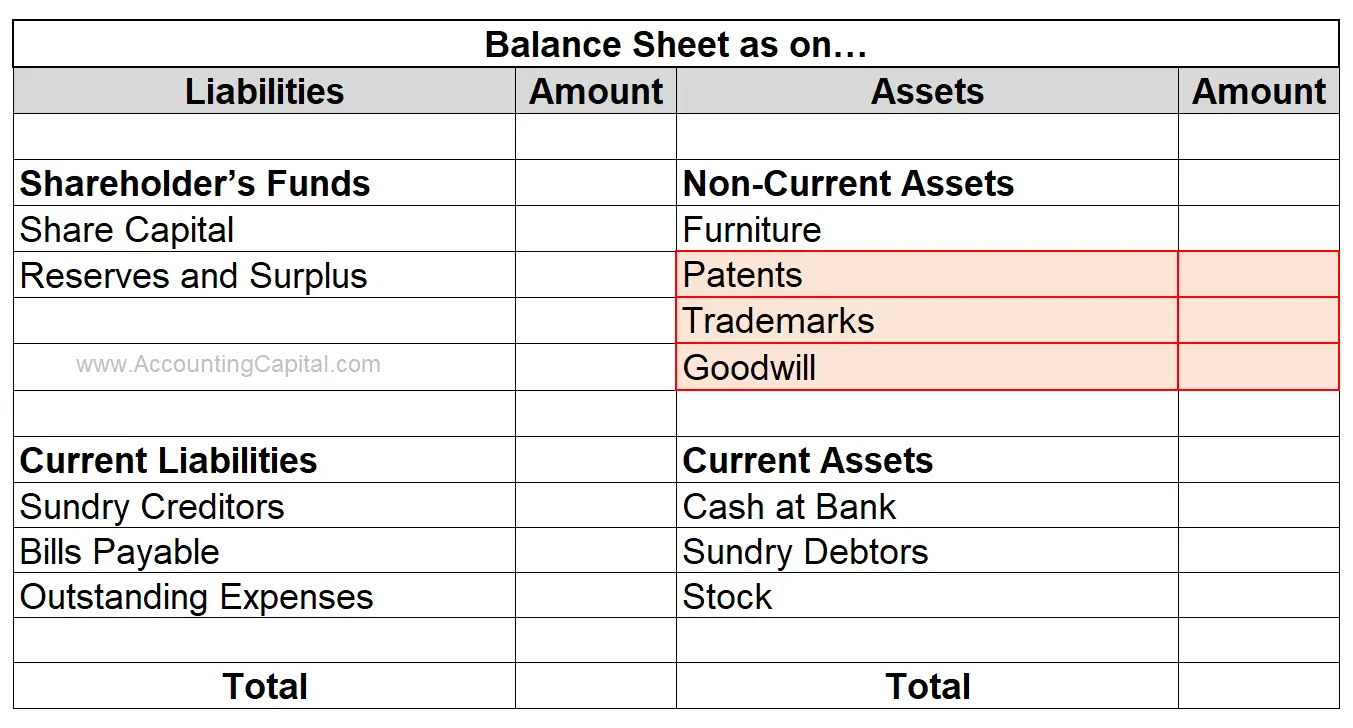

Intangible Assets in Financial Statements

Intangible assets are also shown on the ‘Assets’ side (right) of the horizontal balance sheet. They are shown in financial statements at their net book value.

Related Topic – Is Debit Balance Positive and Credit Balance Negative?

Examples of Intangible Assets

Some modern examples are customer data, website domains, social media handles, videos, training modules, software licenses, logos, etc.

More common examples

- Patents

- Copyrights

- Trademarks

- Franchises

- Goodwill, etc.

Related Topic – Is Goodwill a Fictitious Asset?

Accounting Intangible Assets

Journal Entry to Record Intangible Asset

An example of a journal entry is to record the acquisition of an intangible asset, such as a patent.

ABC Ltd. purchased a new patent worth 90,000 for their business.

| Patent A/C | 90,000 |

| To Bank A/C | 90,000 |

Explanation:

The company purchased a patent, which is considered an intangible asset.

- The patent account is debited with the cost, which in this case is 90,000. This represents an increase in the assets.

- The bank account is credited with the same amount, 90,000 as it was paid by a cheque. This reflects a decrease in the bank balance.

They are usually shown under the head “Intangible Assets”.

Related Topic – Fixed Assets vs Current Assets

Is a fixed asset an intangible asset?

Many people ask “Are fixed assets and tangible assets the same?”. The answer is “No”. Two different categories that are different and unique from one another.

Fixed assets are tangible, physical assets, while intangible assets are non-physical assets with no tangible form. While both contribute to a company’s overall value and have some overlap, they have distinct properties.

Is goodwill a fixed asset?

Intangible assets such as goodwill are not considered fixed assets. A company’s intangible assets and fixed assets contribute to its overall value, but they’re different categories of assets.

Goodwill is the premium a company pays when acquiring another company above the fair market value. In the case of no acquisition, it can also be viewed as the intangible value associated with a business’s reputation, customer relationship, reputation, etc.

>Read Difference Between Tangible and Intangible Assets