Journal Entry for Purchase Returns or Return Outwards

Sometimes goods purchased by a business are unfit for use and may need to be returned to the respective supplier(s). This may happen due to several different reasons, in business terminology, this action is termed purchase returns or return outwards. Journal entry for purchase returns or returns outwards is explained further in this article.

All such events related to returned goods are documented in the final accounts as they have a monetary impact. Depending on a transaction’s terms and conditions, goods purchased both in cash and credit may be returned.

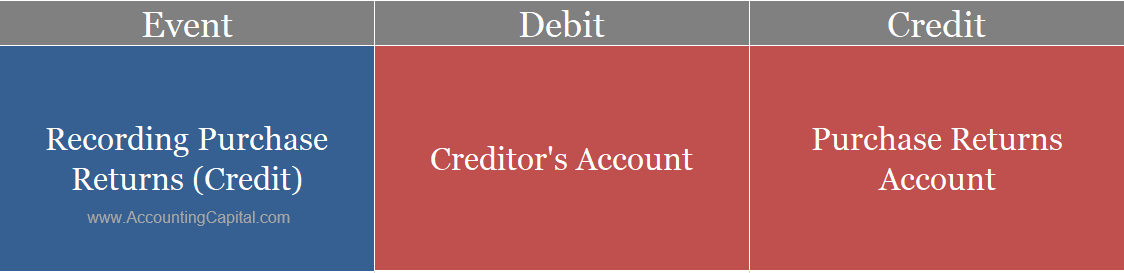

Journal Entry for Purchase Returns or Return Outwards (in Credit)

| Creditor’s Account | Debit | Debit the decrease in liability |

| To Purchase Returns | Credit | Credit the decrease in expense |

Treatment of Purchase Returns in the Financial Statements

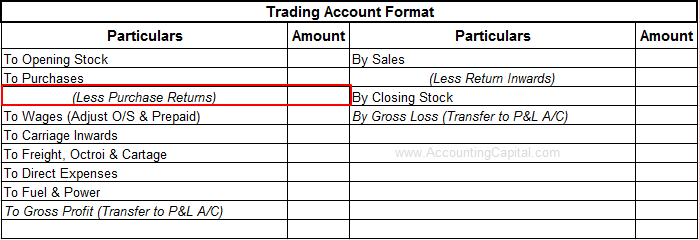

Return outwards or purchase returns are shown in the trading account as an adjustment (reduction) from the total purchases for an accounting period.

It is not shown in the income statement or the balance sheet.

Related Topic – What is COGS or Cost of Goods Sold?

Example – Journal Entry for Purchase Returns

Unreal Corporation purchased raw materials worth 90,000 on credit from ABC Corporation. However, at the time of delivery of the goods 5,000 worth of goods were found unfit because of inferior quality.

These goods were returned back to ABC Corporation. Post an accounting entry for purchase returns in the books of Unreal Corporation.

Journal entry for purchase returns in the books of Unreal Corporation

| ABC Corp. A/C | 5,000 |

| To Purchase Returns | 5,000 |

As per the three golden rules of accounting,

| ABC Corp. Account | Personal | Debit | Debit the Receiver |

| Purchase Returns Account | Nominal | Credit | Credit all incomes/gains |

Purchase return isn’t exactly a gain or an income for the company, however, it reduces liability (in case of credit purchase), therefore, it indirectly acts as a gain.

Top Reasons for Purchase Returns

- The customer ordered an incorrect product or size.

- The seller delivered an incorrect product or size.

- Products delivered in damaged or defective condition.

- Bad quality products.

- More products are purchased than required.

Short Quiz for Self-Evaluation

Revision & Highlights Short Video

Highly Recommended!!

Do not miss our 1-minute revision video. This will help you quickly revise and memorize the topic forever. Try it :)

>Read Accounting and Journal Entry for Sales Return