-This question was submitted by a user and answered by a volunteer of our choice.

Return Inwards

The return inwards arises when goods sold are returned back by the customers. They might return the entire order or only a part of it. It is also known as Sales Returns. Such returns are deducted from sales on the credit side of the Trading Account.

Journal entry for Return Inwards

When there is a return inwards, the following journal entry is passed-

| Return Inwards A/c | Debit | Amt |

| To Debtor’s A/c | Credit | Amt |

(Goods returned by the customer)

As per Modern rules of Accounting,

| Return Inwards A/c | Revenue Account | Debit the decrease in revenue |

| Debtor’s A/c | Asset Account | Credit the decrease in asset |

As per Traditional rules of Accounting,

| Return Inwards A/c | Nominal Account | Debit all expenses and losses |

| Debtor’s A/c | Personal Account | Credit the giver |

For example,

ABC Ltd. is a dealer in smartphones and the company sells them on Amazon which has a 30-day replacement guarantee scheme especially when the customer buys a certain electronic item. Hence when the customer returns the smartphone that he purchased it becomes a return inward and hence, it will be deducted from ABC’s sales.

Return Outwards

The return outwards arises when the goods purchased are returned. It is also known as Purchase Returns. Such returns are deducted from purchases on the debit side of the Trading Account.

Journal entry for Return Outwards

When there is a return outward, the following journal entry is passed-

| Creditors’ A/c | Debit | Amt |

| To Return Outwards A/c | Credit | Amt |

(Goods returned to the seller)

As per Modern rules of Accounting,

| Creditor’s A/c | Liability Account | Debit the decrease in liability. |

| Return Outwards A/c | Expense Account | Credit the decrease in expense. |

As per Traditional rules of Accounting,

| Creditor’s A/c | Personal Account | Debit the receiver |

| Return Outwards A/c | Nominal Account | Credit all incomes and gains |

For Example,

ABC Ltd. is a watch dealer and the company has placed an order with a supplier to supply 20 Smart Watches but he sent 5 watches of a different model so ABC returned them. This is a case of return outward as ABC is sending goods back to the supplier and hence it shall be deducted from the purchases.

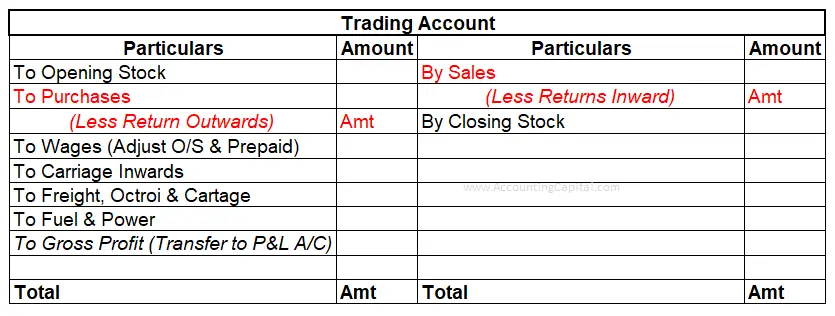

Accounting Treatment of Return Inwards and Return Outwards

- Return Inwards

- Return inwards are deducted from sales in the Trading Account, giving net sales.

- It is not shown in the Balance Sheet.

2. Return Outwards

- Return outwards are deducted from purchases in the Trading Account, giving net purchases.

- It is also not shown in the Balance Sheet.

Conclusion

The key takeaways from the above discussion are:

- When the goods sold by a business are returned by the customers, it is known as Returns Inward or Sales Return.

- When the goods purchased by a business are returned to the suppliers, it is known as Returns Outward or Purchase Return.

- Return inwards are deducted from sales in the Trading Account, giving net sales.

- Return outwards are deducted from purchases in the Trading Account, giving net purchases.