Table of Contents

Introduction

A fixed deposit as the name suggests is a “deposit of money” with a bank or a similar financial institution that is “fixed” for a set time. When a business makes such a deposit this event is recorded as a “journal entry to place money in fixed deposit”.

When a fixed deposit reaches maturity, it earns interest, which is considered an income for the depositor. By investing in an FD today, the firm plants a seed that will bear fruit later on. It is a simple investment product that offers peace of mind and assured returns on a liquid asset.

Risk-averse investors prefer fixed deposits because they are stable & guaranteed in nature. It keeps your principal safe and shields you from market fluctuations.

Recommended Quiz – Journal Entries (Beginner)

Journal Entry

The journal entry to place money in fixed deposit is;

| Fixed Deposit A/c | Debit |

| To Bank A/c | Credit |

(Being money placed as fixed deposit with..)

Accounting Rules applied – “Fixed Deposit A/c” is debited as an increase in assets (receivables) is debited. “Bank A/c” is credited as a decrease in assets (bank balance) is credited.

Related Topic – Journal Entry for Cheques Dishonoured

Example of the Accounting Entry to Place Money in Fixed Deposit

Apsara traders placed 50,000 for a year in a fixed deposit with the HSBC Bank. Pass the necessary accounting entry.

The journal entry for the above transaction would be;

| Fixed Deposit A/c | 50,000 |

| To HSBC Bank A/c | 50,000 |

(Being money placed as fixed deposit with HSBC bank)

When investing in a fixed deposit, you mainly worry about increasing asset value. Therefore, we debit the fixed deposit account with 50,000 to reflect the asset value increase.

The bank account, on the other hand, is credited by 50,000 to reflect the decrease in bank balance, following the principle of ‘credit the decrease in assets’.

Related Topic – Journal Entry for Opening Stock

Impact on Financial Statements

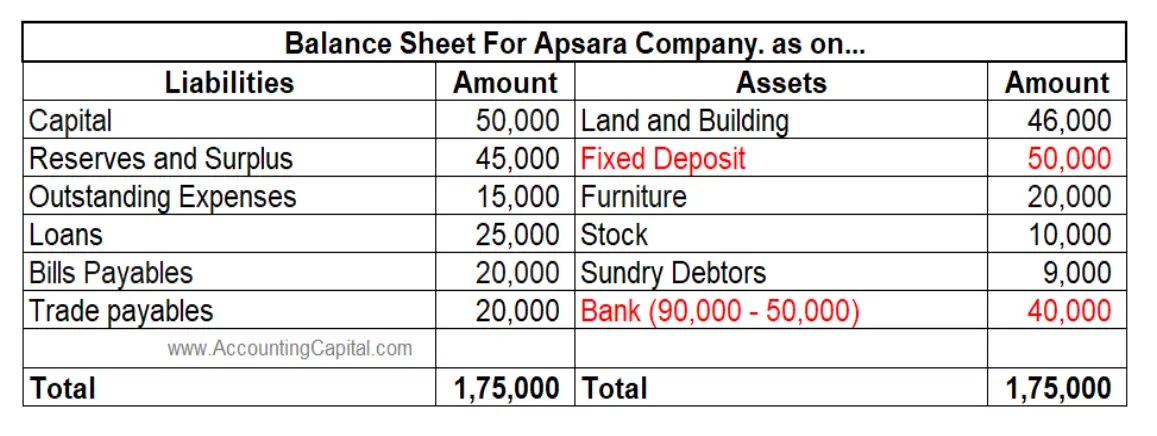

This journal entry will have an impact on the balance sheet. Fixed deposits and bank accounts are considered assets. Therefore the accounting entry will impact the asset side of the balance sheet. Considering that a fixed deposit account did not exist previously

Considering that a fixed deposit account did not exist previously

Firstly, a fixed deposit is a monetary asset. So, there will be an increase in fixed deposit accounts. Secondly, there will be a decrease in the current assets as there is a decrease in funds available at the bank.

According to the above example, we can see that a new fixed deposit account was created for the Apsara company. The bank account on the assets side of the balance sheet is reduced. This is because the money is being transferred to the fixed deposit account.

- Trading Account/Income Statement: Fixed deposits don’t translate into business expenses or income, so placing money in a fixed deposit won’t impact the trading account & income statement.

- Cash Flow Statement: The decrease in bank balance would go under “operating activities”, but the increase in fixed deposits would go under “investing activities”.

Although fixed deposits themselves are typically recorded as financial assets, interest earned on them may be shown as an off-balance-sheet item if it’s accrued but not yet received.

Related Topic – Journal Entry for Provident Fund

Conclusion

- An FD is an asset for the firm therefore any increase in investment leads to a debit whereas a reduction in liquid assets leads to a credit.

- At the time of maturity, the business has the option to renew the deposit for another term or withdraw the money.

- At the time of maturity, the firm needs to record the proceeds received, along with any accrued interest, as income.

- Firms can manage risk a better way with fixed deposits, which help diversify their investment portfolios.

- A fixed deposit can be used for future capital expenditures, expansion plans, or unforeseen emergencies.

- Tax benefits may be available to the investing entity on the interest earned on fixed deposits. This depends a lot on the prevailing tax laws and regulations of the country.

>Read Journal Entry for Interest on Capital