Table of Contents

Introduction

A cheque is a financial instrument that acts as a written order sent by the account holder to its bank instructing them to pay a certain amount of money to someone. Cheques are the most common bill of exchange used for business payments.

Whenever an account owner writes a cheque, they authorise the bank to release money on their behalf, which may sometimes be denied. When a bank does not honour a cheque, it’s called bounced, dishonoured, or returned. Such an event is recorded with the help of a journal entry for cheques dishonoured.

This may happen due to various reasons:

- Insufficient funds

- Closed account

- Signature mismatch

- Account frozen, etc.

There are three parties involved in the whole process;

- Drawer: The one who writes the cheque.

- Payee: The person who should receive these funds

- Drawee: In the case of a cheque, the bank is always supposed to pay on the drawer’s behalf.

Recommended Quiz – Bills of exchange

Journal Entry

Assuming that a cheque received from a debtor was dishonoured.

Step 1: When the cheque is received.

| Bank A/c | Debit |

| To Debtor’s A/c | Credit |

The bank account is debited as the cheque received is considered an increase in funds. The debtors are reduced since the money owed to the company is being reduced.

Rules applied – “Bank A/c” is debited as an increase in assets is debited whereas “Debtor’s A/c” is credited as a decrease in receivables (asset) is credited.

Traditional Rules: “Bank A/c” is a personal account therefore debit the receiver and “Debtor’s A/c” is a personal account therefore credit the giver.

Recommended Quiz – Classification of Accounts (Real, Personal & Nominal)

Step 2: When the cheque received is dishonoured, the journal entry for cheques dishonoured would be;

| Debtor’s A/c | Debit |

| To Bank A/c | Credit |

Since an entry was recorded in the books for the cheque being received, an entry needs to be passed to reverse/cancel the cheque dishonour.

Rules applied – “Debtor’s A/c” is debited as this leads to an increase in receivables (asset) whereas “Bank A/c” is credited as this leads to a decrease in the bank balance (asset) which was assumed to go up when the cheque was in hand.

Related Topic: Journal Entry for Bank Overdrafts

Example of the Accounting Entry for Cheques Dishonoured

RTA Traders (a debtor) paid 10,000 by cheque to Kumar’s business. The cheque was dishonoured. Record the entry in the accounting books of Kumar’s.

| RTA Traders A/c | 10,000 |

| To Bank A/c | 10,000 |

(Being cheque dishonoured due to A/c closed)

- The RTA company is in debt of 10,000 again after the check bounces because there aren’t enough funds. This means an increase in receivables (an asset) for Kumar’s business. Therefore RTA Co. account is debited.

- The official bank account of Kumar’s business will be credited because there is a perceived decrease in the bank balance due to a bad cheque.

Related Topic: Journal Entry for Payment to Creditor

Impact on the Financial Statements

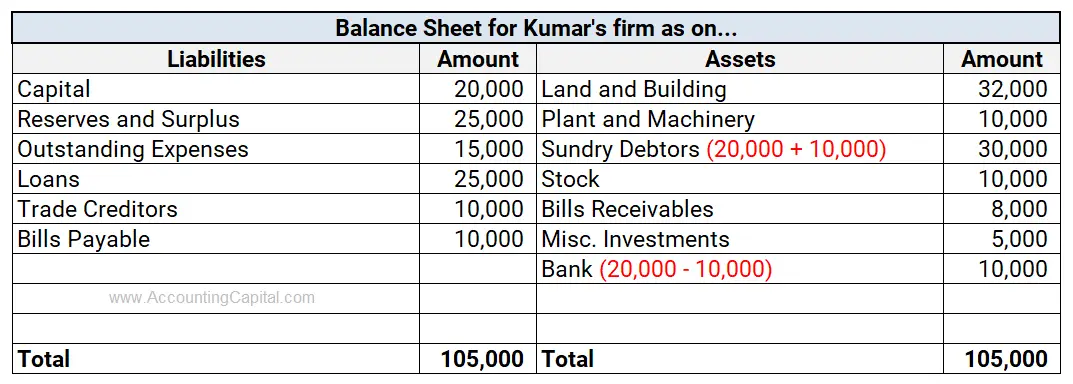

This journal entry will have an impact on the balance sheet.

There will be changes made on the asset side of the balance sheet. There will be an increase in debtors since they haven’t paid back. There will be a decrease in the bank account since the amount hasn’t been added to the bank account due to the returned cheque. There will be no changes or impact on the liabilities side of the balance sheet.

There will be no changes or impact on the liabilities side of the balance sheet.

There will be no impact on the cash flow statement or the profit & loss account.

Related Topic: Fixed Assets Vs Intangible Assets

Conclusion

- A cheque dishonour reverses the original transaction recorded when the debtor sent the payment via cheque.

- It’s typically a debit to the debtor’s account and a credit to the bank account to record the bounced cheque.

- The reversal of the cheque dishonour typically increases the debtor’s account balance, reflecting the reinstatement of the receivable amount.

- Liabilities are not affected, but capital might be, especially if revenue from the cheque was previously recognized in the income statement.

>Read What is Profit and Loss Credit Balance?