Overview of Prepaid Insurance

Prepaid Insurance is the amount of insurance premium which has been paid in advance in the current accounting period. However, the related benefits corresponding to the insurance amount prepaid will be received in the next accounting period. In other words, the insurance premium is paid before it is actually incurred.

Prepaid Insurance is an example of Prepaid Expenses. It is a current asset since its benefit will be received within a year. The actual amount pertaining to the next accounting period is recorded on the asset side of the balance sheet of the current year. Thus, prepaid insurance has a debit balance just like any other asset and it is debited in the books of accounts.

As the benefits of prepaid insurance are realized over time, the asset value decreases, and the amount is shown as an expense in the income statement of the organization. The adjustment related to prepaid insurance in the financial statements is carried out at the appropriate time i.e. both in the current period and in the future period (when it becomes due).

As per the Modern Rules of Accounting

| Account | Increase | Decrease |

|---|---|---|

| Asset | Debit (Dr.) | Credit (Cr.) |

Prepaid Insurance (Asset) is Debited (Dr.) when increased & Credited (Cr.) when decreased.

Why is it like this?

This is a rule of accounting that cannot be broken under any circumstances. Prepaid insurance is an asset to the entity. Therefore, as per the modern rules of accounting for assets an increase in assets will be debited.

How is it done?

For instance, HP Inc. paid the insurance premium for its equipment’s amounting to 50,000 on 10/12/20×1. This insurance policy covers the next 12 months. The amount paid towards insurance increases the assets of the business hence it is debited in the books of accounts.

Given below is the journal entry for recording prepaid insurance in the financial books. (Rule Applied – Dr. the increase in Asset)

| Prepaid Insurance A/c | Debit |

| To Cash A/c | Credit |

(Insurance premium for next year paid in cash.)

The balance at the end of the year is shown on the asset side of the balance sheet and the amount is carried forward to the next year.

As per the Golden Rules of Accounting

| Account | Rule for Debit | Rule for Credit |

|---|---|---|

| Personal | Debit the Receiver | Credit the Giver |

Prepaid Insurance is debited as per the golden rules.

Prepaid Expenses are referred to as representative personal accounts (accounts that represent a certain person or group of people). According to the rule for personal accounts, we have to debit the receiver of the benefit and credit the giver of the same.

As per the golden rules of accounting (for personal accounts), prepaid insurance is debited.

Example

J P Morgan Inc. paid the insurance premium for all its furniture amounting to 100,000 on 31/12/20×2. However, the entire amount of premium paid relates to the year 20×3 (Accounting period-Jan 20×2 to Dec 20×2).

Given below is the example of the journal entry for prepaid insurance, for which the Prepaid Insurance Account is debited. (Rule Applied – Dr. the receiver.)

| Prepaid Insurance A/c | Debit |

| To Bank A/c | Credit |

(Insurance premium for next year paid through the bank.)

The debit balance at the end of the year is shown on the asset side of the balance sheet and the amount is carried forward to the next year.

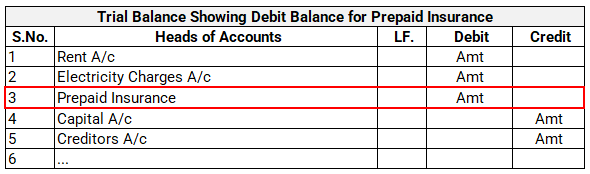

Prepaid Insurance Inside Trial Balance

Prepaid insurance shows a debit balance in the trial balance. A trial balance example showing a debit balance for prepaid insurance is provided below.

Here, only the amount for 3 months is prepaid and it is recorded on the asset side of the balance sheet.

Read

>Related Long Quiz for Practice Quiz 36 – Prepaid Expenses