Overview of Rent Paid in Advance

Rent paid in advance means the payment of any rent obligation prior to the rental period in which it is due. It is an example of prepaid expense. Since the prepaid rent does not relate to the current accounting period, it is recorded on the asset side of the balance sheet.

Rent paid in advance is a current asset, thus the Rent Paid in Advance A/c is debited in the financial books of the organization. It is to be charged as an expense later when the benefit is received i.e. during the respective period to which the rent relates.

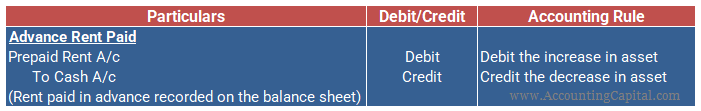

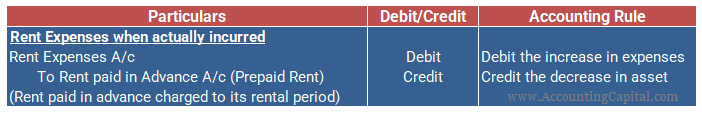

Journal entry as per Modern Rules of Accounting

| Account | Increase | Decrease |

|---|---|---|

| Asset | Debit (Dr.) | Credit (Cr.) |

| Expenses | Debit (Dr.) | Credit (Cr.) |

When such rent is paid in advance it can be called an asset since it will generate some economic value for an organization or an entity in the future. According to the modern rules of accounting, an increase in an asset is debited in the books of accounts.

Cash and bank are current assets and when an entity makes an advance payment of rent, the cash-in-hand balance with an entity reduces. Hence, as per the Modern Rules of Accounting, we credit the decrease in cash balance.

The journal entry for recording Rent paid in Advance is provided below: (Rule Applied: Debit the increase in asset, Credit the decrease in asset)

The journal entry for recording Rent expenses incurred is provided below: (Rule Applied: Debit the increase in expenses, Credit the decrease in assets)

Example

Mr. Max pays a rent of 10,000 every month. Thus, the landlord and Mr. Max entered into an agreement that Mr. Max will pay rent at the beginning of each quarter for the entire quarter. So, Mr. Max pays at the beginning of every quarter the amount of 30,000.

The journal entries for the above shall be:

| Prepaid Rent A/c | 30,000 | Debit |

| To Cash A/c | 30,000 | Credit |

(Being rent paid in advance)

And at the end of every month, the journal entry to be passed shall be –

| Rental Expenses A/c | 10,000 | Debit |

| To Prepaid Rent A/c | 10,000 | Credit |

(Being rental expense incurred at every month’s end)

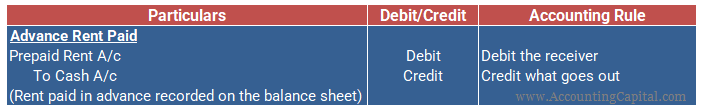

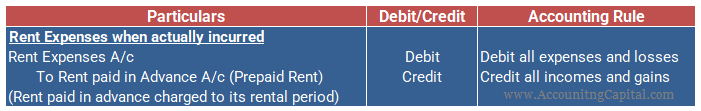

Journal entry as per the Golden Rules of Accounting

| Account | Rule for Debit | Rule for Credit |

|---|---|---|

| Nominal | Debit all expenses and losses | Credit all incomes and gains |

| Personal | Debit the Receiver | Credit the Giver |

Payment towards rent is classified as a “nominal account”. A nominal account represents any accounting event that involves expenses, losses, revenues, or gains. It is what you would call a profit and loss or an income statement account. As per the golden rule of accounting for a nominal account, rent expenses are debited to the books of accounts.

When nominal accounts (expenses and incomes) become prepaid or outstanding, they are classified as Representative persons and the golden rule of personal accounts is applied. Thus, prepaid rent is debited as per the golden rules of accounting.

The journal entry for recording Rent paid in Advance is provided below: (Rule Applied: Debit the receiver)

The journal entry for recording Rent expenses incurred is provided below: (Rule Applied: Debit all expenses and losses)

Example

Ms. Jane rented office space and she paid 4 months of rent to the landlord in advance. Therefore, ‘Prepaid rent A/c’ is debited and when the rent is incurred, the balance of prepaid rent is written off. The journal entry for the same is given below.

| Prepaid Rent A/c | Debit |

| To Cash A/c | Credit |

(Being rent paid in advance)

And at the end of every month, the journal entry to be passed shall be –

| Rental Expenses A/c | Debit |

| To Prepaid Rent A/c | Credit |

(Being rental expense incurred at every month’s end)

Rent paid in Advance in Trial Balance

The rent paid in advance shows a debit balance. A trial balance example showing a debit balance for prepaid rent is provided below.