-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of Prepaid Expenses

Prepaid expenses refer to the advance payment of goods or services the benefits of which shall be received in the future. Prepaid expenses are considered assets on the balance sheet because they represent items paid for in advance that will become expenses over time as they are used or consumed.

Examples of prepaid expenses are insurance premiums, rent, subscriptions, utilities, etc.

Type of Account

Prepaid expenses are considered a current asset since it will benefit in the future. The prepaid expenses will be adjusted in the next couple of months within the operating year hence it is a current asset.

Expenses such as prepaid rent, insurance, etc. are shown in the trial balance on the debit side as they are initially an asset for the business, however, once the benefit is received, the value of the asset falls.

Journal entry for prepaid expenses

As per modern rules,

| Particulars | Debit | Credit | Rule |

| Prepaid expenses A/c | Amt | Debit increase in asset | |

| To Cash A/c | Amt | Credit decrease in Asset |

The prepaid expenses are leading to an increase in current assets. It will be debited. The cash account will be credited since it leads to a decrease as it is used to make payments for prepaid expenses.

As per traditional rules,

| Particulars | Debit | Credit | Rule |

| Prepaid expenses A/c | Amt | Real A/c- Dr what comes in | |

| To Cash A/c | Amt | Real A/c – Cr what goes out |

Prepaid expenses are coming in into the firm as it is debited as per the real account rule. As cash is used to make the payment for the prepaid expenses it is credited since cash is going out of the firm.

Expenses such as prepaid rent, insurance, etc. are shown in the trial balance on the debit side as they are initially an asset for the business, however, once the benefit is received, the value of the asset falls.

Example

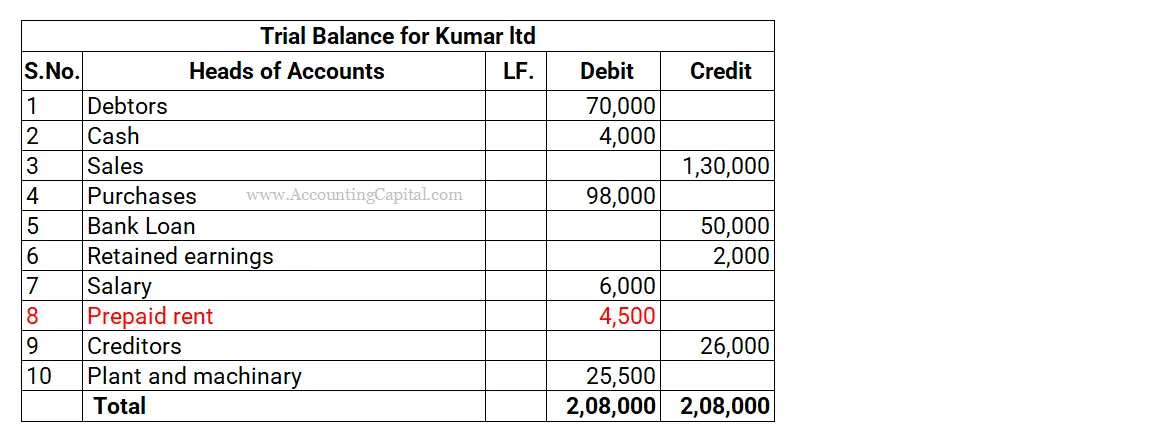

The trial balance of Amar Ltd. shows the rent amounting to 4,500 as a prepayment for April.

This prepaid rent of 4,500 is shown in the trial balance as follows:

Trial Balance as of 31st March, Kumar Ltd

Note

- If the prepaid expenses are already shown in the trial balance it means that an adjusting entry has already been recorded in the books of accounts and they shall be further recorded only in the balance sheet of the company.

- It shall be shown in the balance sheet of the company under current assets.

- However, if prepaid expenses are not shown in the Trial Balance, then they shall be added to their respective accounts and recorded on the debit side in the Profit and Loss A/c.

Conclusion

- Prepaid expenses are debited since it leads to an increase in assets. The cash account is credited since the money is used to pay for the prepaid expenses.

- Prepaid expenses are considered as a current asset since it is used up within the operating year.

- This helps in reducing administrative burden since it is already paid. It reduces administrative processes related to procurement and payment. This shows the operational efficiency of the company related to cash management.

- Prepaid assets are recorded as assets on the balance sheet until it is utilized. This can improve the financial statement of the company related to liquidity ratios and asset turnover ratios, which is important for investors and creditors.

related Long Quiz for Practice Quiz 36 – Prepaid Expenses