-This question was submitted by a user and answered by a volunteer of our choice.

What is Income Received in Advance?

Income received in advance is the income received but not due. In other words, when a business receives an income for a service not yet rendered, it is considered as income received in advance. It may be commission, rent, or any other income which is received before it is due.

Why is Income Received in Advance treated as a current liability?

In simple words, income received in advance is treated as a current liability because the income that has been received by the company before its due date, is not yet earned and the company is obliged to deliver the purchased goods or services in the future.

Let us assume that you have received an amount from a customer, for the goods or services that you will provide in the future, therefore, in the current financial period it is a liability for your company. It can be referred to as Deferred revenue, Deferred income, or Unearned income.

Example

XYZ Ltd. has received 4,000 from a customer in March for goods that will be delivered in April.

XYZ Ltd. will debit the Cash a/c for 4,000 and credit the Deferred Revenue a/c for 4,000. On the 31st of March, the balance sheet of XYZ Ltd. shall include 4,000 in the cash of their company and record the deferred revenue of 4,000 under current liabilities.

The journal entries to be recorded are as follows:

| March | Cash a/c | Debit | 4,000 | Debit the increase in asset |

| To Deferred Revenue a/c | Credit | 4,000 | Credit the increase in liability |

(Being income received in advance)

The above Journal entry records the transaction of receiving the cash in advance in the month of March for the goods that are to be delivered in April.

| April | Deferred Revenue a/c | Debit | 4,000 | Debit the decrease in liability |

| To Sales Revenue a/c | Credit | 4,000 | Credit the increase in revenue |

(Being goods sold to the customer)

In the above Journal entry, the Deferred Revenue Account is debited and the sales revenue account is credited to show that the goods have been delivered and revenue has been earned.

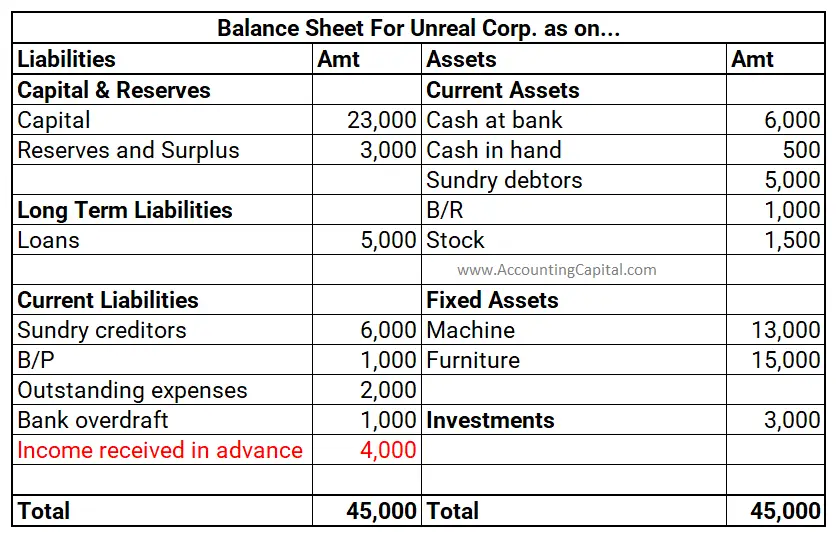

Placement in the balance sheet

An extract of the balance sheet is given below to show the placement of income received in advance:

Conclusion

The key takeaways from the above article are as follows:

- Income received in advance is the income not yet due but received.

- Income received in advance is treated as a liability.

- This is because the business has yet to render the services for the income already received by it.

- It is shown as a current liability under the Liabilities side of the Balance Sheet.

- It is also referred to as Deferred revenue, Deferred income, or Unearned income.

>Related Long Quiz for Practice Quiz 22 – Current Liabilities

>Related Long Quiz for Practice Quiz 31 – Income received in Advance