Overview of Sales Return

When the customer returns the goods purchased back to the seller, the transaction is referred to as a sales return. It is also known as Return Inwards. The buyer may return the goods to the seller due to excessive purchases, defective goods, or any such reason. For recording this transaction, adjustments can be made to the Sales A/c or a separate Sale Return A/c can be created in the books of the business.

The sales account has a credit balance, so when a sales return occurs, it decreases the sales, which is why the sales return account is debited and the respective accounts receivable are credited.

When the customer returns the goods to the business, it reduces the Accounts Receivable and is a ‘loss’ or ‘expense‘ for the organization, hence sales return is a nominal account and is debited in the books of the organization.

As per Modern Rules

| Account | Increase | Decrease |

|---|---|---|

| Expense | Debit (Dr.) | Credit (Cr.) |

Sales Return is Debited (Dr.) when increased & credited (Cr.) when decreased.

Why is it like this?

This is a rule of accounting that is not to be broken under any circumstances.

How is it done?

For example, ABC Corporation sold goods to their customer on credit. Upon delivery of the goods, the customer found a few defective items which they returned to the organization. In the financial books, the Sales return account will be debited since it is an increase in expense for the organization.

Given below is the timeline of how it would be recorded in the financial books.

Step 1 – The following journal entry is recorded in the books of accounts when the defective items are returned. (Rule Applied – Dr. the increase in expense)

| Sales Return A/c | Debit |

| To Debtor A/c | Credit |

(Goods returned by the customer.)

Step 2 – To transfer the expense to “Trading A/c”.

| Trading A/c | Debit |

| To Sales Return A/c | Credit |

(Goods returned by the customer are transferred to the trading account)

As per the Golden Rules of Accounting

| Account | Rule for Debit | Rule for Credit |

|---|---|---|

| Nominal | All Expenses and Losses | All Incomes and Gains |

Sales Return (Expense) is Debited (Dr.)

As per the golden rules of accounting for (nominal accounts) expenses and losses are to be debited.

The account of expenses, losses, incomes, and gains are called Nominal accounts. The balance of these accounts is always zero at the beginning of the financial year. Since the sales return is an expense for the business, it is to be debited.

Example

For example, XYZ Corporation sold goods to their customer on credit. Upon delivery of the goods, the customer found a few defective items which they returned to the organization. In the financial books, the Sales return account will be debited since it is an expense for the organization.

Step 1 – For the above example, the journal entry for the goods returned, “Sales Return A/c” is debited. ( Rule Applied – Dr. all incomes and gains)

| Sales Return A/c | Debit |

| To Accounts Receivable A/c | Credit |

(Goods returned by the customer.)

Step 2 – To transfer the expense to the “Trading Account”

| Trading A/c | Debit |

| To Sales Return A/c |

Credit |

(Goods returned by the customer are transferred to the trading account)

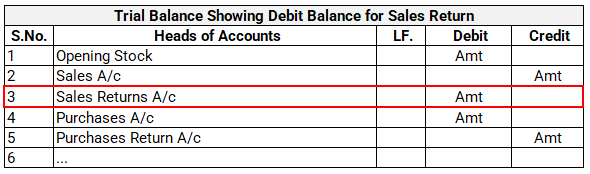

Sales Return Inside Trial Balance

Sales returns show a debit balance in the trial balance. A trial balance example showing a debit balance for sales return is provided below.

Read