Days Payable Outstanding (DPO)

Days payable outstanding or DPO is the average number of days that a company takes to pay its outstanding suppliers after a credit purchase has been recorded.

It is used for the estimation of an average payment period and helps to determine the efficiency with which the company’s accounts payable are being managed.

Days payable outstanding or DPO is usually a monthly activity and it may fluctuate every month. This can be due to multiple business scenarios such as seasonality, change in business policies, economics, etc.

It is useful for preserving working capital, however, while preserving the working capital a company also needs to ensure that all payments to its suppliers are done within the due date. Monitoring the DPO enables the management to ensure that cash is utilized optimally and the payment terms with creditors are maintained.

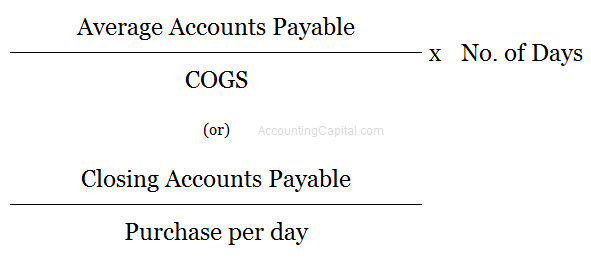

Formula to Calculate Days Payable Outstanding (DPO)

LOW DPO – The company is taking less number of days to pay back to its suppliers. This is usually a sign of good financial health.

HIGH DPO – The company is taking more number of days to pay back to its suppliers. This may be done temporarily as a strategic decision or it may be a result of week liquidity of the company.

Related Topic – What is Purchase Book (with Template)?

Example

Below are the details of a trading business.

| Average AP for April | 25,000 |

| Cost of Goods Sold in April | 2,50,000 |

| No. of days in the month | 30 |

| DPO | (25,000/2,50,000)*30 |

Days Payable Outstanding = 3 Days

It means the average number of days that the company takes to pay its invoices is 3 days.

Short Quiz for Self-Evaluation

>Read Days Sales Outstanding