Table of Contents

Introduction

In your business, a debtor is a party that owes money to you. Imagine you run a small stationery store. When someone comes into your shop and buys something but chooses to pay later, they become your debtor. In simple terms, they have an outstanding expense to settle with you for the items they bought.

In future, they may issue a cheque to settle the dues. The term “cheque received” does not always mean the immediate receipt of money. When a business receives a cheque from a customer or another party, it represents a promise of payment.

The actual receipt of money occurs when the cheque is deposited into the bank account and the funds are cleared. Whenever debtors pay their bills via cheque, it is recorded with the help of a journal entry.

Received Cheque from Debtor Journal Entry

- When the cheque is received but not deposited in the bank on the same day,

| Cheque in Hand A/C | Debit |

| To Debtor’s A/C | Credit |

- Dr. the increase in ‘Assets’. It is a legal promise to pay & considered a receivable.

- Cr. the decrease in ‘Assets’ as debtors/receivables are reduced.

- ‘Cheque in Hand’ is a Real A/c; therefore, Dr. what comes in.

- ‘Debtor’ is a Personal A/c; therefore, Cr. the giver.

- When the cheque is received and deposited in the bank on the same day,

| Bank A/C | Debit |

| To Debtor’s A/C | Credit |

Modern Rules

- Dr. the increase in ‘Assets’ as money comes into the business.

- Cr. the decrease in ‘Assets’ as debtors/receivables are reduced.

Golden Rules

- ‘Bank’ is a Personal A/c therefore, Dr. the receiver.

- ‘Debtor’ is a Personal A/c therefore, Cr. the giver.

Related Topic – Debtor’s Turnover Ratio

Example

- When the cheque is received but not deposited in the bank on the same day,

Example – PQR Ltd. received a cheque from Mr A for 50,000 as payment for goods sold last week. Pass the journal entry in the books of PQR Ltd.

| Cheque in Hand A/c | 50,000 |

| To Mr A’s A/c | 50,000 |

- When the cheque is received and deposited in the bank on the same day,

Example – PQR Ltd. received a cheque from Mr A for 50,000 as payment for goods sold. It was deposited in the bank on the same day.

| Bank A/c | 50,000 |

| To Mr A’s A/c | 50,000 |

Related Topic – Journal Entry for Money Received from Debtor

Effect on Financial Statements

Income Statement: The cheque receipt itself does not directly impact the income statement.

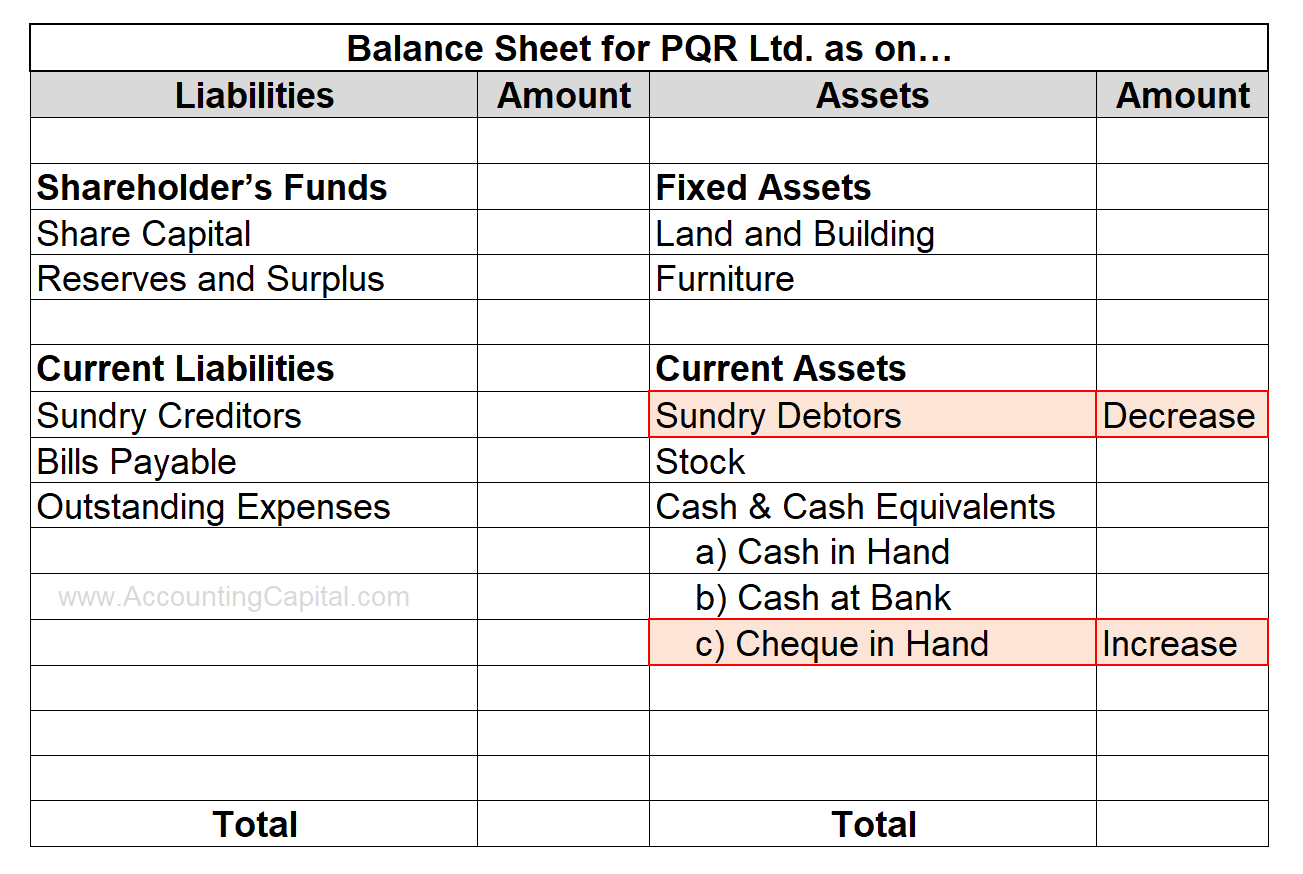

Balance Sheet: Cheque-in-hand is treated as an asset for the organisation. It is shown under the heading ‘Cash and Cash Equivalents’ on the ‘Assets’ side.

Related Topic – What is the Difference Between Debtors and Creditors?

Related Topic – What is the Difference Between Debtors and Creditors?

Honour and Dishonour of Cheque

In the scenario of receiving a cheque from a debtor, the honour or dishonour of the cheque impacts the collection of payment. The terms “honour” and “dishonour” refer to the outcome of the cheque when presented for payment.

There are various reasons which lead to the dishonour of cheques. Some of the reasons for the dishonour of cheques are insufficient balance in the drawer account, stop payment, mismatching signatures, etc.

When a cheque received from a debtor is honoured, it has an impact on the accounting records.

Cash Receipt: The amount mentioned on the cheque is considered cash received by the business. This increases the cash balance on the balance sheet.

Debtors/Accounts Receivable: The accounts receivable balance decreases by the same amount as the honoured cheque. This reflects the fact that the debtor has fulfilled their payment obligation, and the outstanding amount owed by the debtor is reduced.

Revenue Recognition: If the payment received represents payment for goods or services, the revenue associated with the sale is recognized in the income statement. This increases the revenue and ultimately impacts the net income of the business.

>Read Journal Entry for Cash Received