Table of Contents

Introduction

Many businesses buy goods or services on credit as it allows the purchasing company to receive goods or services immediately and pay for them at a later date. A creditor is an individual or entity to whom the business owes money for goods or services received.

Working capital is often managed with short-term credit. In this way, firms can pay suppliers, salaries, and other short-term obligations. Creditors are considered a liability and any payment made to them is recorded as a “journal entry for payment to creditor”.

Types of Creditors

- Secured: Creditors who have a specific claim over an asset as collateral and lend money to the company.

- Unsecured: Creditors who don’t have any specific claim over an asset as collateral and lend money to the company.

Related Topic – Journal Entry for Purchased Goods on Credit

Journal Entry

As per the modern rules of accounting,

| Creditor A/c | Debit |

| To Bank A/c | Credit |

(Being payment made to the creditor)

- Creditor A/c is a liability therefore debit the decrease in liabilities.

- Bank A/c is an asset therefore credit the decrease in assets.

- Creditor A/c is a personal account therefore debit the receiver.

- Bank A/c is a personal account therefore credit the giver.

Related Topic – Journal Entry for Sold Goods on Credit

Example of the Accounting Entry for Payment to Creditor

XYZ firm owes 50,000 to Unreal Company.

Journal entry for payment to creditor in this case would be as follows;

| Unreal Company A/c | 50,000 |

| To Bank A/c | 50,000 |

(Being payment made to Unreal Co.)

The XYZ firm is repaying its short-term debt to the Unreal Company, which decreases its liability, while the creditor (Unreal Company) is getting money. Consequently, the Unreal Company will be debited with 50,000.

As XYZ firm is paying the money from its bank, there will be a decrease in assets and the money will go out. Hence, the bank account will be credited with 50,000.

Related Topic – Difference Between Fixed Capital and Working Capital

Impact on Financial Statement

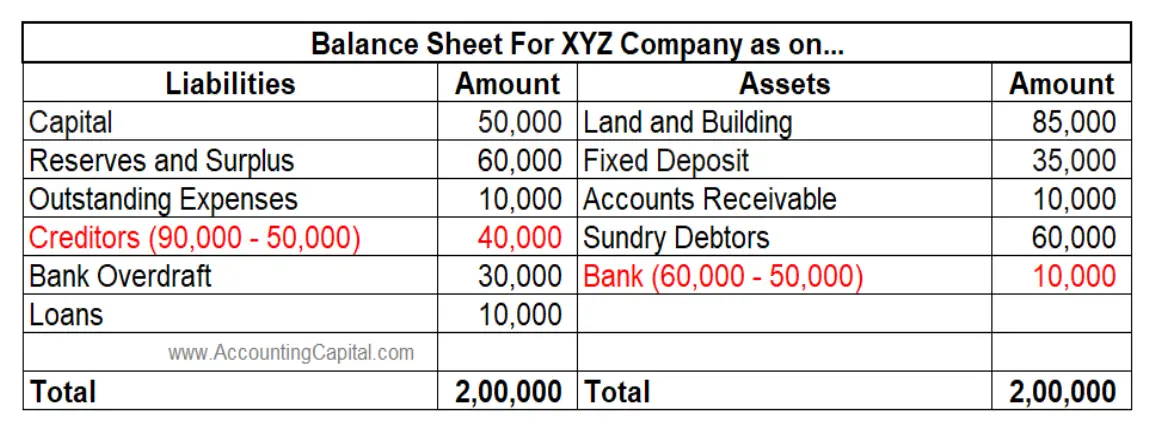

The journal entry related to the “payment of creditors” will affect the balance sheet.

- It affects the bank account in the current assets column. As the payment is made through a bank account there will be a decrease in the balance. If payment is made through cash, then there will be a decrease in the cash.

- It will also affect the liabilities side of the balance sheet. Creditors are current liabilities and repayment means a decrease on the balance sheet. Hence, there will be a reduction on the liabilities side.

In the above image, it is imagined that the firm’s total creditors were 90,000 out of which 50,000 were paid using the official bank account. This is the reason for the reduction of 50K from both creditors & the bank account.

In the above image, it is imagined that the firm’s total creditors were 90,000 out of which 50,000 were paid using the official bank account. This is the reason for the reduction of 50K from both creditors & the bank account.

This journal entry will not affect the income statement.

This journal entry will affect the cash flow statement. It affects the operating activities of the cash flow statement. It will recorded as ‘cash outflow’ since cash is going out while paying the creditor.

Related Topic – Journal Entry for Cheque Received from Debtor

Conclusion

This accounting entry will be recorded since it is based on monetary transactions. It is recorded to help with financial accuracy in the balance sheet.

- The creditor’s account is debited because the creditor receives money. This leads to a decrease in liabilities for the business.

- The bank account is credited since the payment is made to the creditors from the business’ official bank leading to a decrease in assets.

- This is vital for both internal and external users of accounting information, e.g. stakeholders, including investors, as it provides a clear picture of the company’s outstanding obligations.

- Keeping an eye on the money you owe to others helps businesses plan for upcoming bills and make sure they have enough money on hand. It helps avoid running into problems where they don’t have the cash they need.

>Read Journal Entry for Bank Charges Paid