-This question was submitted by a user and answered by a volunteer of our choice.

Yes.

Let’s take a set of transactions and prepare all the requisite information asked.

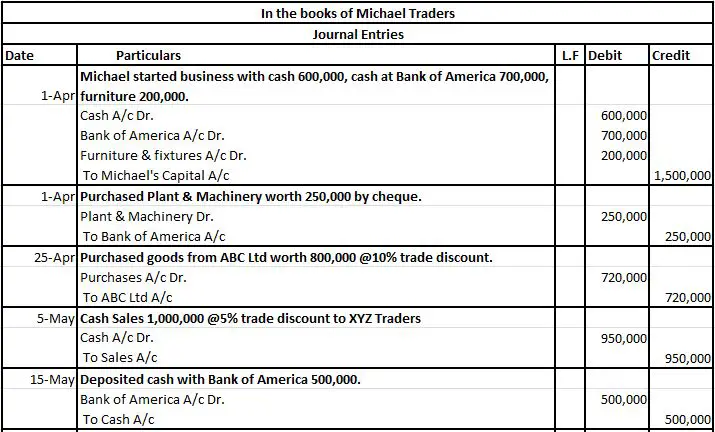

Following are the transactions for the period April 20×1 to March 20×2 in the books of Michael Traders

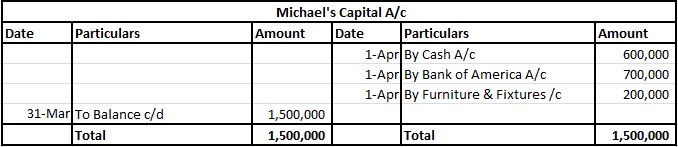

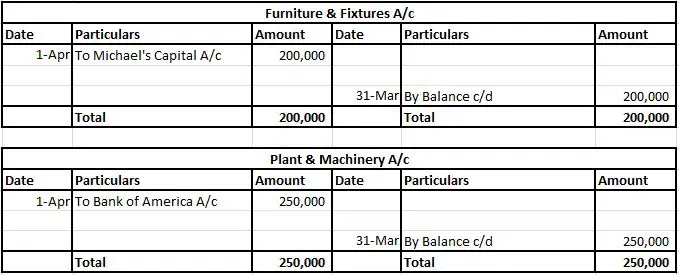

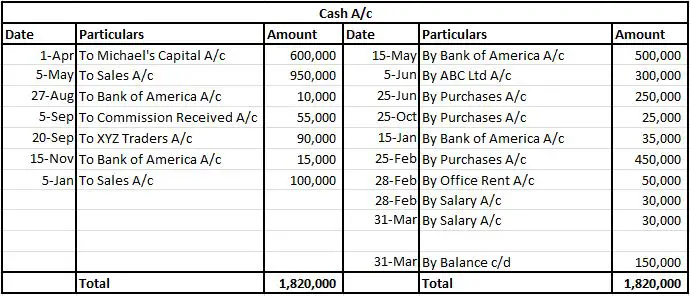

| 1-Apr | Michael started a business with cash 600,000, cash at Bank of America 700,000, furniture 200,000. |

| 1-Apr | Purchased Plant & Machinery worth 250,000 by cheque. |

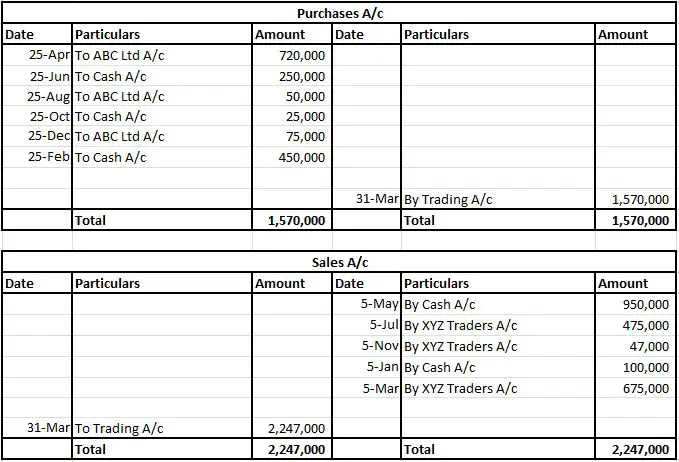

| 25-Apr | Purchased goods from ABC Ltd worth 800,000 @10% trade discount. |

| 5-May | Cash Sales 1,000,000 @5% trade discount to XYZ Traders |

| 15-May | Deposited cash with Bank of America 500,000. |

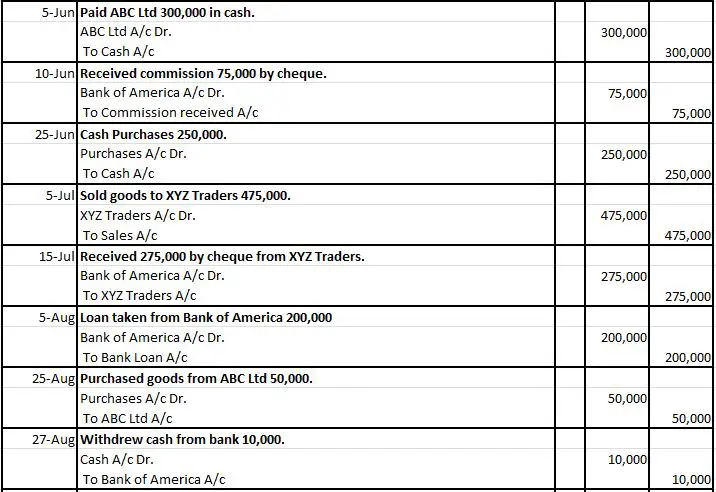

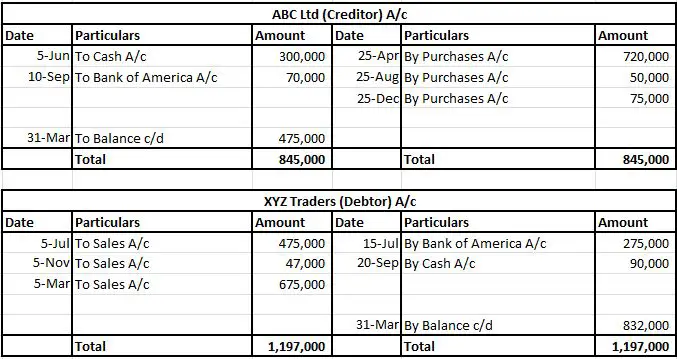

| 5-Jun | Paid ABC Ltd 300,000 in cash. |

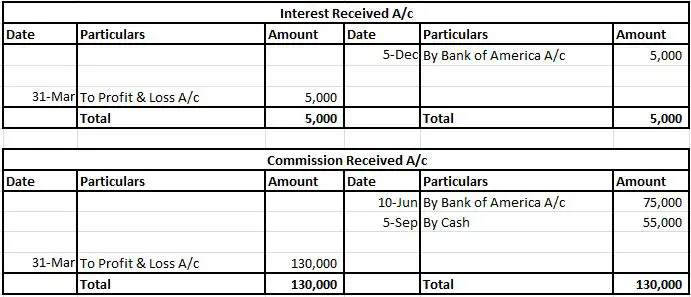

| 10-Jun | Received commission 75,000 by cheque. |

| 25-Jun | Cash Purchases 250,000. |

| 5-Jul | Sold goods to XYZ Traders 475,000. |

| 15-Jul | Received 275,000 by cheque from XYZ Traders. |

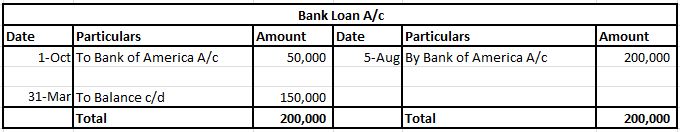

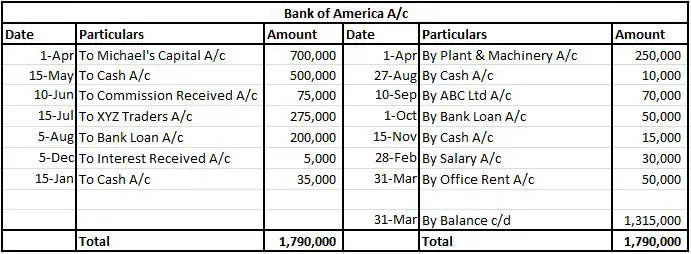

| 5-Aug | Loan taken from Bank of America 200,000 |

| 25-Aug | Purchased goods from ABC Ltd 50,000. |

| 27-Aug | Withdrew cash from bank 10,000. |

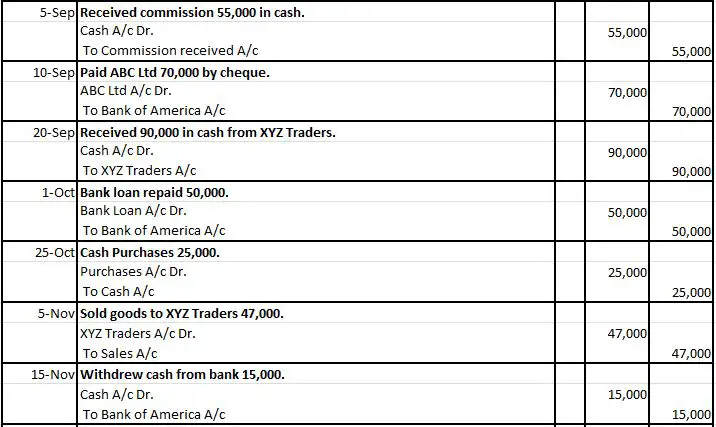

| 5-Sep | Received commission 55,000 in cash. |

| 10-Sep | Paid ABC Ltd 70,000 by cheque. |

| 20-Sep | Received 90,000 in cash from XYZ Traders. |

| 1-Oct | Bank loan repaid 50,000. |

| 25-Oct | Cash Purchases 25,000. |

| 5-Nov | Sold goods to XYZ Traders 47,000. |

| 15-Nov | Withdrew cash from bank 15,000. |

| 5-Dec | Received interest from bank 5,000. |

| 25-Dec | Purchased goods from ABC Ltd 75,000. |

| 5-Jan | Cash Sales 100,000. |

| 15-Jan | Deposited cash with Bank of America 35,000. |

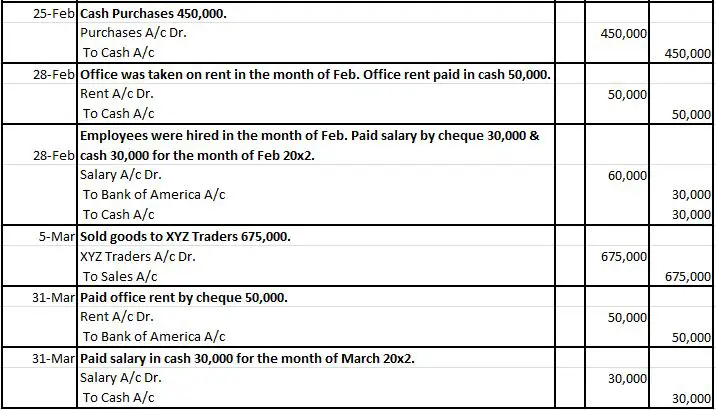

| 25-Feb | Cash Purchases 450,000. |

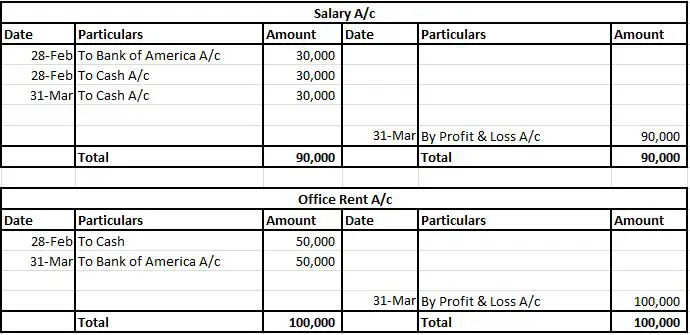

| 28-Feb | Office was taken on rent in the month of Feb. Office rent paid in cash 50,000. |

| 28-Feb | Employees were hired in the month of Feb. Paid salary by cheque 30,000 & cash 30,000 for the month of Feb 20×2. |

| 5-Mar | Sold goods to XYZ Traders 675,000. |

| 31-Mar | Paid office rent by cheque 50,000. |

| 31-Mar | Paid salary in cash 30,000 for the month of March 20×2. |

You are required to;

(i) Journalize the above transactions and post them in Ledgers and prepare a Trial Balance.

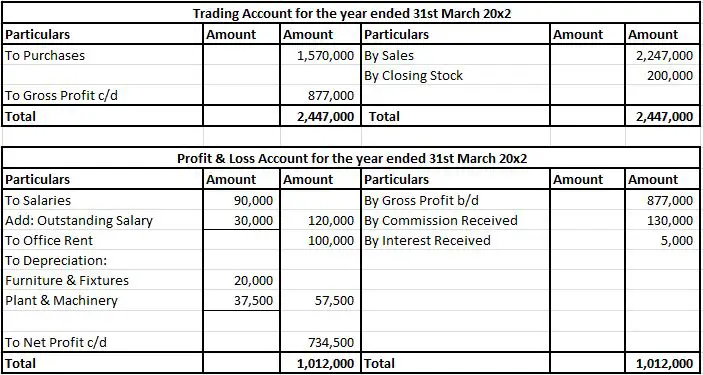

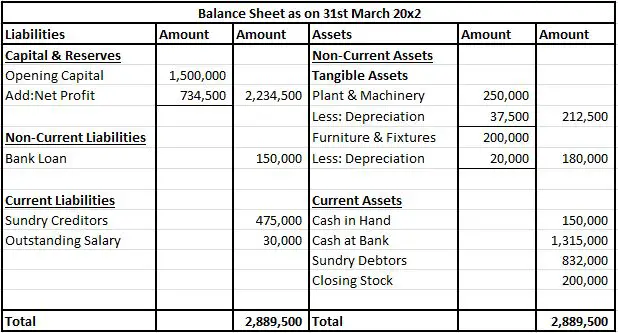

(ii) Prepare Trading A/c, Profit & Loss A/c and Balance Sheet taking into consideration:

1. Closing Stock as of 31st March 20×2 is 200,000.

2. Salary outstanding for the month of March 20×2 is 30,000.

3. Depreciation@10% to be charged on Furniture & Fixtures and @15% on Plant & Machinery.

1. Journal Entries

2. Ledgers

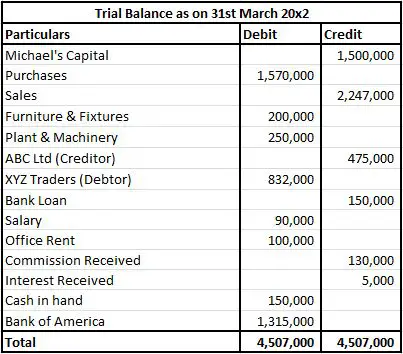

3. Trial Balance

4. Trading A/c & Profit and Loss A/c

5. Balance Sheet

An Excel sheet of the entire transactions along with the requisite information asked has been attached for your reference.

30-transactions-of-Journal-Ledger-Trial-Balance-Financial-Statements

>Read Try our Accounting Quiz on the Topic “Accounting Cycle”