Return Inwards

Return inwards are goods returned to a business by its customer(s). They are goods which were once sold to external third parties, however, because of being unsatisfactory, they were returned by the customer. They are also called “Sales Returns”.

Inward returns reduce the total accounts receivable for the business. It is a sales return and on the other, it is a purchase return. The transaction in both cases is reversed and the related sale or purchase is nullified.

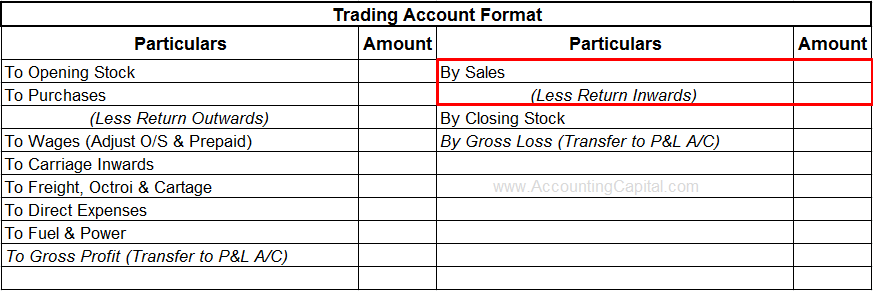

This reversal reduces the total sales of a company and the deduction is shown in the trading account. A subsidiary book called Sales returns book is prepared to record all such entries.

Journal Entry for Return Inwards

| Return Inwards A/C | Debit | Debit the decrease in revenue |

| To Customer’s A/C | Credit | Credit the decrease in assets |

Return Inwards – This is a reduction in revenue for the business.

Customer – This is a reduction in receivables for the business.

Shown in Trading Account (Deducted from Sales)

Related Topic – What is Purchase Returns Book?

Example

Let’s suppose a customer “Star Pvt Ltd.” returned goods worth 5,000 to “Unreal Corp.”. The journal entry to record these sales returns in the books of Unreal Corp. will be as follows;

| Return Inwards A/C | 5,000 |

| To Star Pvt Ltd. A/C | 5,000 |

Short Quiz for Self-Evaluation

>Read Return Outwards