Trade Discount vs Cash Discount

Discounts play an important role in business transactions. They have has been part of business transactions since the beginning of time. Buyers offer discounts and sellers receive it, either implicitly or explicitly. The purpose of this article is to explain the difference between trade discount and cash discount in detail.

Trade Discount

1. Trade discount is a reduction granted by a supplier of goods/services on the list or catalogue prices of the goods supplied.

2. It is provided due to business considerations such as trade practices, large quantity orders, market competition, etc.

3. Trade discount is not separately shown in the books of accounts; all net amounts after discount are recorded in the subsidiary books of accounting.

4. It is allowed on both credit and cash transactions.

5. Trade discount is given on the basis of purchase.

6. There is no separate journal entry for trade discount allowed or received as it is not recognized as an expense for the business.

Example for Trade Discount

10 vehicles were purchased by Unreal Pvt Ltd with a 5% trade discount on the list price of 1,00,000 each.

Total List Price = 10 x 1,00,000 = 10,00,000

Total Discount = 5% of 10,00,000 = 50,000

Final Invoice Price after TD = 10,00,000 – 50,000 = 9,50,000

Related Topic – How to Show Trade Discount in Purchase Book?

Cash Discount

1. Cash discount is a deduction allowed by a supplier of goods or by a provider of services to the buyer from the invoice price.

2. It is provided as an incentive or a motivation in return for paying a bill within a specified time.

3. Cash discount is shown separately in the books It is shown as an expense in the Profit and Loss A/C.

4. It is only allowed on cash payments.

5. Cash discount is given on the basis of payment.

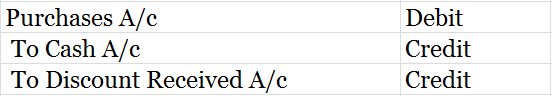

6. Journal entry for cash discount received by a business;

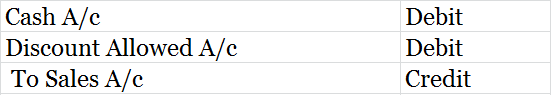

Also, journal entry for cash discount allowed by a business;

Example for Cash Discount

Let’s continue the example above for the trade discount. Assuming that the supplier, in addition, extended a cash discount of 2% 10 Net 30 days.

This means that if the buyer pays within 10 days of delivery, they can avail extra 2% discount on the invoice price.

So, Invoice Price = 9,50,000

2% of 9,50,000 = 19,000

Net amount to be paid within 10 days = 9,50,000 – 19,000 = 9,31,000

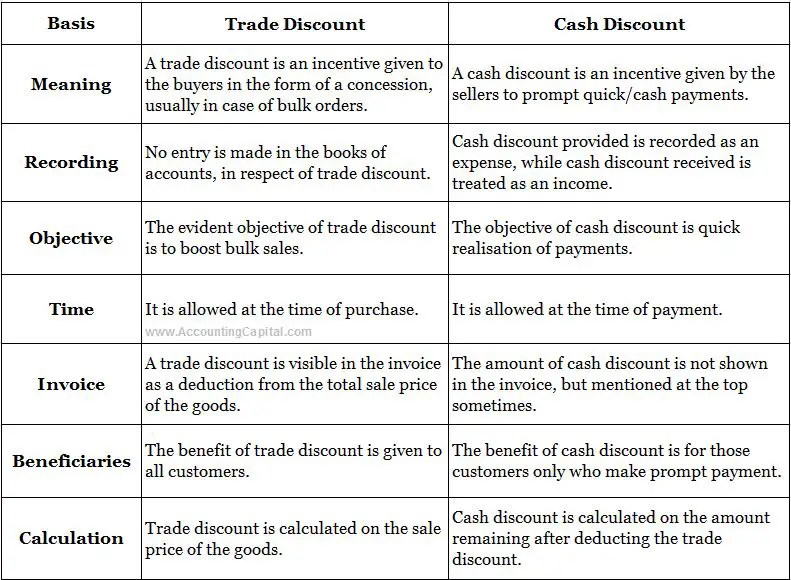

Difference in Table Format

How to calculate a cash discount and trade discount?

Trade Discount

A trade discount is calculated on the list price itself before any transaction takes place. In other words, it will be calculated on the list price and then deducted from the same. Eventually, the remaining amount becomes the sale price or the invoice price for the items. The records will be kept on the basis of this final amount only.

It is usually unconditional and benefits all buyers. It may vary according to the quantity being purchased.

Cash Discount

A cash discount, on the other hand, is calculated on the invoice price of the items. Suppliers or wholesalers usually provide their buyers with a credit period. If the buyer makes a quick payment within the mentioned credit period, the seller offers an additional discount on the pre-decided invoice price (that may or may not be net of existing trade discount). This will be termed as a cash discount.

It works under certain conditions and is not available for all buyers. It may vary according to the time of payment.

Example

Z is a regular customer of ABC Ltd who is a wholesale dealer of television sets. Z wants to purchase some sets from ABC Ltd. Listed price of a television set is 11,000.

Following conditions are being specified:

- ABC Ltd. offers to sell one television set for 10,000 if Z makes a purchase of at least 100 sets, which amounts to a trade discount of 9.09%.

- Z agrees and places an order of 100 sets at a rate of 10,000 per set. ABC Ltd further specifies that the credit period provided is 15 days.

- Payment within the credit period will benefit Z with an additional cash discount of 2%. Z makes the payment on the 10th day of the purchase.

Price of goods = 100 * 11,000 = 1,100,000

Less trade discount 9.09% = 100,000

Amount payable by Z = 1,000,000

When Z makes payment on the 10th day, he will have to pay only 980,000 (1,000,000 – 2% of 1,000,000).

Journal Entry

- There is no journal entry for trade discount provided as in the above case. The discounted price of 1,000,000 becomes the sale price of the items.

- The cash discount of 2% amounting to 20,000 will be an expense for the business and will be recorded in the books of accounts.

- A cash discount is not mentioned in the catalogue and is provided over and above the trade discount. Hence, it is important to keep a track of such expenses in the books of accounts.

The final entry at the time of payment, in the books of ABC Ltd, will show the cash worth 980,000 as debit as this is the amount being received. The cash discount of 20,000 will also be a debit since it is an expense for the business. The total accounts receivable worth 1,000,000 will be credited as total assets (receivables) are being reduced.

A ledger account for “cash discount” will also be opened in the general ledger. This will further reflect in the income statement as an expense.

>Read Journal Entry for Cash Discount