-This question was submitted by a user and answered by a volunteer of our choice.

Accounts receivable as an asset

I think before getting onto this question you should have a clear idea about what does an account receivable means.

An account receivable refers to an amount due to be received by the company for the sale of goods or services rendered. It’s the value of goods that the customer has not yet paid even though he has received the title of goods or enjoyed services.

In simple words, any sum of money owed by a person for purchase made on a credit basis refers to an account receivable.

For Example,

Uber Inc. purchases 2000 units of smartphones from Apple Inc. for gifting them to its employees it purchases it on a 45 days credit and the amount remains due on a reporting date hence such an amount due becomes an account receivable for Apple Inc.

Moving ahead, the answer to your question is that ” account receivable is an asset”.

Why is it an asset?

As explained earlier accounts receivable is the money owed by the client to the company. Hence, it can be said that the company has a right to receive the money since it has already delivered a product or rendered service. Because of this, the customer must pay the company within a specific time frame.

And so it’s an Asset since it ensures the future economic benefit for the company.

The accounting treatment of such a transaction at the time of making a credit sale;

| Accounts Receivable a/c | Debit | Increase in Asset |

| To Sales a/c | Credit | Increase in Revenue |

And at the time of actual receipt of cash;

| Cash A/c | Debit | Increase in Asset |

| To Accounts Receivable A/c | Credit | Decrease in Asset |

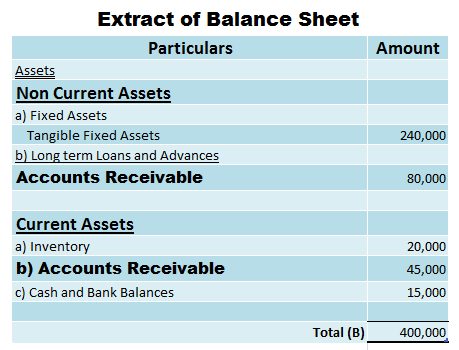

It shall be presented in the balance sheet under the head of the current asset if the amount is receivable within a year and beyond that, it’s recorded under the head of non-current assets

In case you are unable to understand the position of such an item in a balance sheet the below example would be of great help

Why is it not revenue?

Revenue is the income generated by an entity. A major part of such revenue comes from sales or if an entity renders services from such services. It covers only that part of it pertaining to the current reporting period.

Whereas the balance in the accounts receivable includes the unpaid dues from the customers for the current reporting period and earlier reporting period.

Thus it can be said that the accounts receivable balance > amount reported in an income statement.

Because of the reasons stated above, it can safely be concluded that accounts receivable is an asset.

If the bad debts exist the company will have to reduce such balance from the total of accounts receivable and will have to debit it in its profit and loss statement.

I have tried to answer it as simply as I can and I hope it helps.

>Related Long Quiz for Practice Quiz 10 – Accounts Receivable – Intermediate