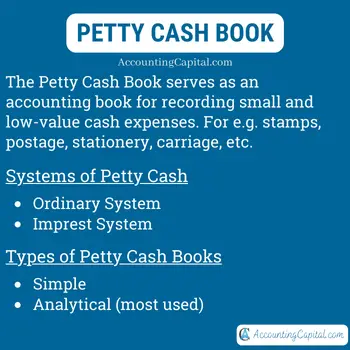

Meaning and Definition

Petty Cash Book is an accounting book used for recording cash expenses which are small and of little value, for example, stamps, postage and handling, stationery, carriage, daily wages, etc.

These are expenses which are incurred day after day; usually, petty expenses are large in quantity but insignificant in value. To record such expenses, a different book known as a petty cash book is maintained. It may be maintained by ordinary or by the imprest system.

Jump to Section

2) Type 1 – Simple Petty Cash Book (with download and format)

3) Type 2 – Analytical Petty Cash Book (with download and format)

4) Simple Petty Cash Book Vs Analytical Petty Cash Book

5) Advantages of Petty Cash Book

6) Accounting (balancing and posting to the ledger)

Systems of Petty Cash

Ordinary system

As part of the normal process of petty cash management, the petty cashier receives an appropriate amount of money.

When the petty cashier spends the amount, he or she submits the account to the head cashier for approval.

Imprest system

The word “imprest” means – A fund that a business uses for small expenditures and usually restores to a fixed amount after a period of time. Imprest system refers to paying an advance at the start and reimbursing the amount spent from time to time.

An Imprest system is where an estimate is made of the amount required to cover small expenses for a given period (for example, a month, quarter, etc.) and the same amount is advanced to the petty cashier as the opening balance.

It is then used by him/her to manage all petty expenses and make the required payments. At the beginning of a new period, the money is replenished when it has been spent. This amount is called imprest money.

Advantages of the Imprest System

Better Accuracy: At regular intervals, the cashier checks the petty cash book to ensure that any mistakes are quickly corrected.

Expense Management: Because petty cash cannot be spent beyond the available petty cash, petty expenses are kept within the limits of imprest.

Fraud Management: As the petty cashier is prohibited from drawing cash as and when we desire, misuse of cash can be minimized.

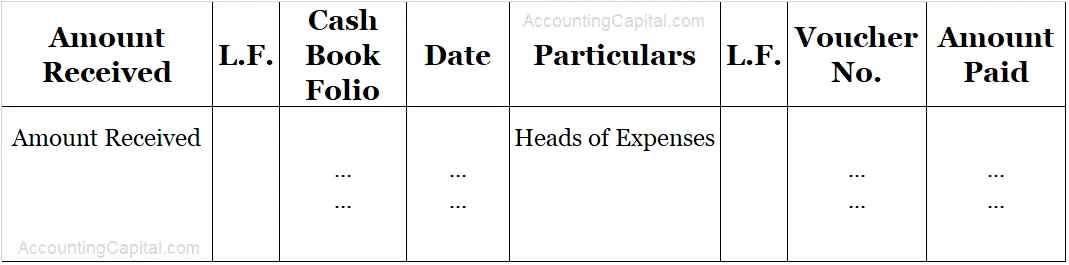

Type 1 – Simple Petty Cash Book

This type of book is maintained just like a cash book. Any cash, which the petty cashier receives, will be recorded on the debit side (left) cash column of the book and any cash which he pays out will be recorded on the credit side (right) cash column of the book.

Format of Simple Petty Cash Book

Download the format in Excel – Download

Download the format in Word – Download

Related Topic – Difference between Cost and Management Accounting

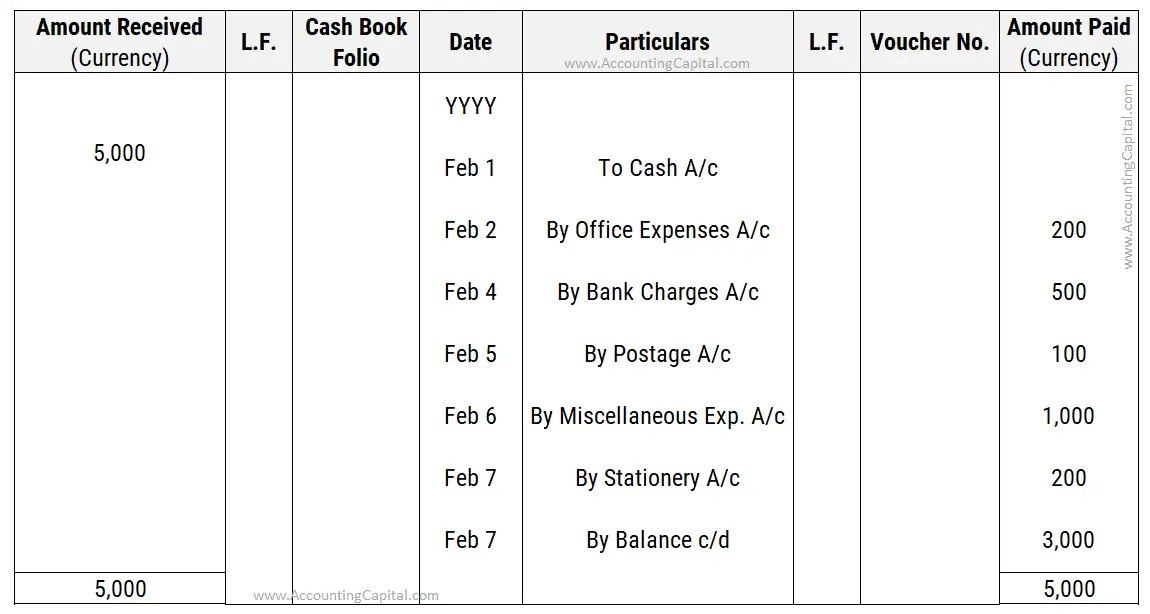

Example for the Simple Type Book

From the following information please show a simple petty cash book for the 1st week of Feb YYYY.

| Details of petty cash transactions | ||

| Date | Particulars | Amt |

| YYYY | ||

| Feb 1 | Received 5,000 for petty cash | |

| Feb 2 | Purchased cutlery for office | 200 |

| Feb 4 | Paid for bank WIRE transfer | 500 |

| Feb 5 | Bought postage stamps | 100 |

| Feb 6 | Paid for parking (client visits) | 1000 |

| Feb 7 | Paid for Stationery | 200 |

Solution (Simple Type)

Related Topic – Why are Subsidiary Books Maintained in Accounting?

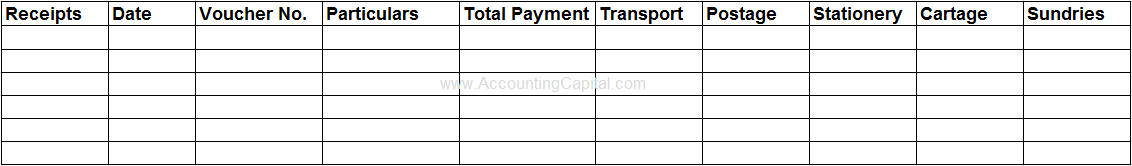

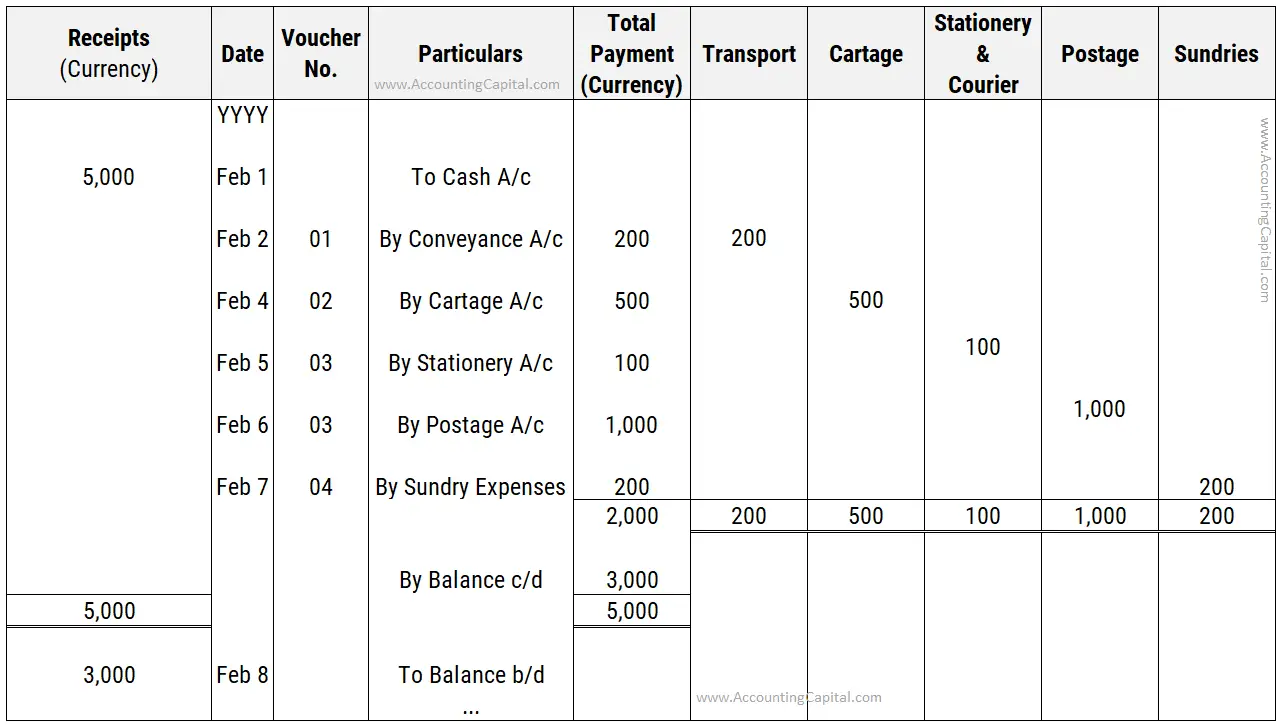

Type 2 – Analytical Petty Cash Book

Considered the most beneficial method of recording petty cash payments. In the analytical version, a separate column is used for each commonly occurring item of expenditure such as stamps, postage & handling, stationery, wages etc.

A column for “sundries” is usually added for miscellaneous payments. When a petty expense is recorded on the right-hand side of the book, the same amount is also recorded in the proper expense column.

Sample Format of Analytical Petty Cash Book

Download the format in Excel – Download

Download the format in Word – Download

Related Topic – Sundry Expenses

Example for the Analytical Type Petty Cash Book

From the following information please show an analytical petty cash book (using the Imprest system) for the 1st week of Feb YYYY.

| Details of petty cash transactions | ||

| Date | Particulars | Amt |

| YYYY | ||

| Feb 1 | Received 5,000 for petty cash | |

| Feb 2 | Paid for taxi fare | 200 |

| Feb 4 | Paid for cartage | 500 |

| Feb 5 | Bought pens and staplers | 100 |

| Feb 6 | Paid for postage stamps | 1000 |

| Feb 7 | Paid for tea and coffee | 200 |

Solution (Analytical Type) Related Topic – Is a Cash Book both Journal and a Ledger?

Related Topic – Is a Cash Book both Journal and a Ledger?

Simple Petty Cash Book Vs Analytical Petty Cash Book

| Simple Petty Cash Book | Analytical Petty Cash Book |

|---|---|

| There is no separate record for each type of petty expense. | In the analysis column, each item of expense that occurs frequently is listed. |

| It is difficult to determine the total expenses under different headings at the end of the period. | It is easy to determine expenses under different headings at the end of the period. |

| In a similar way to a cash book, each page is divided down the middle. | A large portion of the page is provided for expenses, with separate columns for expenses incurred on a regular basis. |

Advantages of the Petty Cash Book

Efficiency: This book helps to save the time of the chief cashier.

Control: Managing small payments is easier with the help of this book.

Reduces Effort: As these entries are not recorded in the cash book and posted into the ledger, redundant and extra work is saved.

Ledger Accounts Prepared Easily: Only the totals are taken and posted in the ledger. Information that is unnecessary & trivial is omitted which helps in direct posting to the ledger.

Related Topic – What is Posting?

Accounting, Balancing, Journal Entry and Posting

Balancing

Balancing of a petty cash book is done at the end of an accounting period. The columns for “payments” and “expenses” are totalled and it equals the total in the “Total Payment” column.

In the analytical type petty cash book, the closing balance (balance c/d) then becomes the opening balance (balance b/d) of the next period.

Petty Cash Journal Entry

(Entry 1) – When the amount is advanced to the petty cashier

| Petty Cash A/c | Debit | Debit the increase in asset |

| To Cash A/c | Credit | Credit the decrease in asset |

(Entry 2) – When petty cashier submits expense accounts

| Expense 1 A/c | Debit | Debit the increase in expense |

| Expense 2 A/c | Debit | Debit the increase in expense |

| Expense 3 A/c | Debit | Debit the increase in expense |

| To Petty Cash A/c | Credit | Credit the decrease in asset |

(Each expense is debited with its respective amount)

Posting

Each item in the book of petty expenses is posted in the ledger accounts at the end of a specific period which is pre-decided (usually – weekly, bi-weekly, monthly, or quarterly)

Ledger entry for each expense is not directly posted instead a petty cash account is maintained in the firm’s ledger.

In the ledger book, each petty expense account is kept separately.

Example to Show Ledger Posting

The petty cashier submitted the below expenses with their respective amounts for the current period amounting to 900. The cashier was advanced 1,000 as petty cash for the period. Post appropriate entries into individual ledger accounts.

Jan 3 – Entry at the start of the period when cash is handed over to the petty cashier,

| Petty Cash A/c | 1,000 |

| To Cash A/c | 1,000 |

The chief cashier records petty cash advances to the petty cashier on the credit side of the cash book as “By Petty Cash A/c”. In this case, the entry would for 1,000.

Jan 9 – Entry for each expense at the time of submission of accounts by the petty cashier,

| Stationery A/c | 500 |

| Cartage A/c | 300 |

| Postage A/c | 100 |

| To Petty Cash A/c | 900 |

To pass the journal entry for total expenses paid, individual petty expenses are debited and credited to Petty Cash Account. A separate account is maintained for each petty expense.

(Solution)

Stationery A/c

| Date | Particulars | Amount | Date | Particulars | Amount |

| Jan 9 | To Petty Cash A/c | 500 |

Journal entry posted in the Stationery account on the debit side by writing “To Petty Cash A/c”.

Cartage A/c

| Date | Particulars | Amount | Date | Particulars | Amount |

| Jan 9 | To Petty Cash A/c | 300 |

Journal entry posted in the Cartage account on the debit side by writing “To Petty Cash A/c”.

Postage A/c

| Date | Particulars | Amount | Date | Particulars | Amount |

| Jan 9 | To Petty Cash A/c | 100 |

Journal entry posted in the Postage account on the debit side by writing “To Petty Cash A/c”.

Petty Cash A/c

| Date | Particulars | Amount | Date | Particulars | Amount |

| Jan 3 | To Cash A/c | 1,000 | Jan 9 | By Stationery A/c | 500 |

| Jan 9 | By Cartage A/c | 300 | |||

| Jan 9 | By Postage A/c | 100 | |||

| Jan 9 | By Balance c/d | 100 | |||

| 1,000 | 1,000 | ||||

| Jan 10 | To Balance b/d | 100 | |||

| Jan 10 | To Cash A/c | 900 |

Journal entries for each receipt and payment are posted in the Petty Cash Account on the debit & credit sides.

Related Topic – Difference Between Journal Entry and Journal Posting

Revision & Highlights Short Video

Highly Recommended!!

Do not miss our 1-minute revision video. This will help you quickly revise and memorize the topic forever. Try it :)

Short Quiz for Self-Evaluation

>Read What is a Journal Proper?