-This question was submitted by a user and answered by a volunteer of our choice.

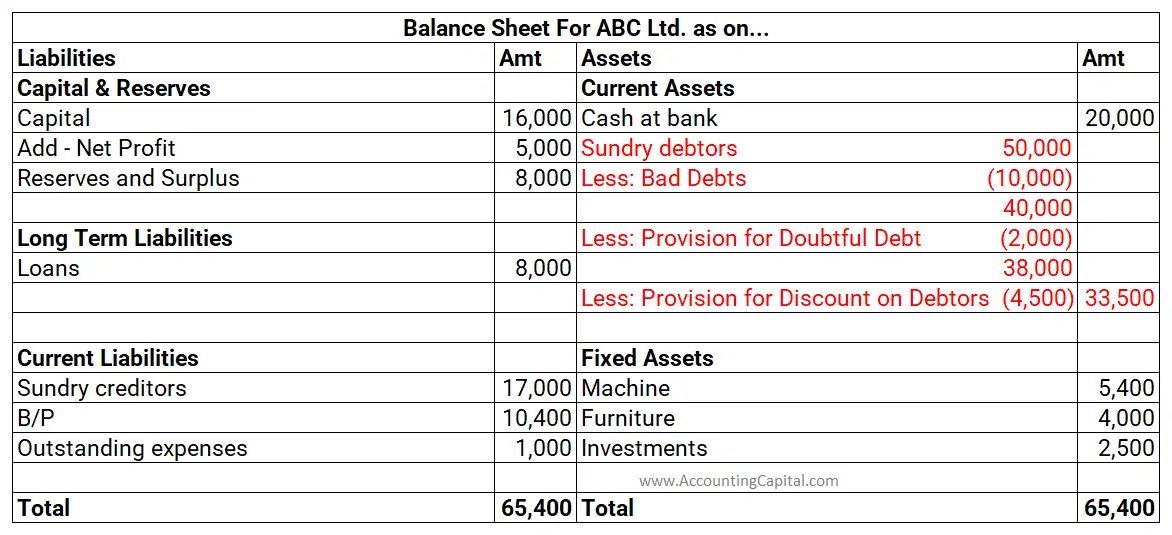

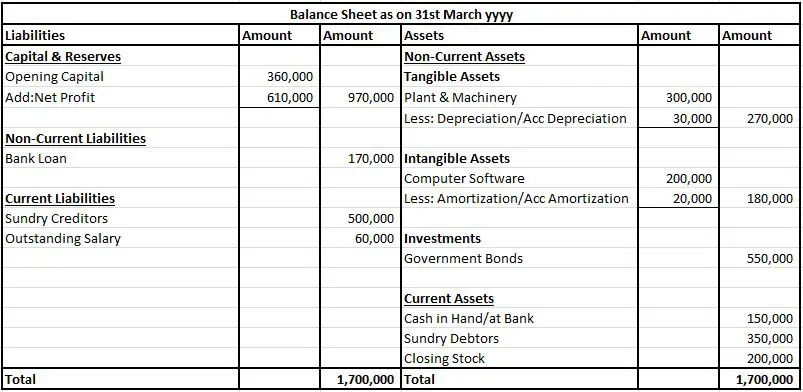

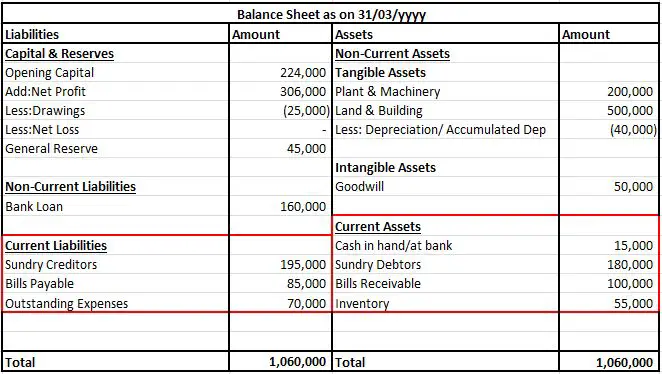

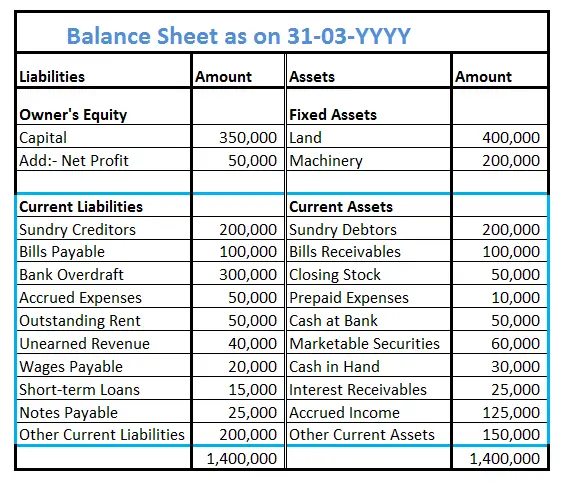

Balance Sheet is a statement showing the financial position of a business entity on a particular day. It shows the liabilities and assets of the business. It consists of items from the trial balance.

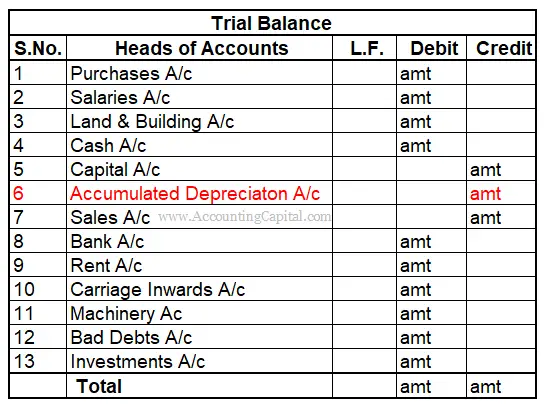

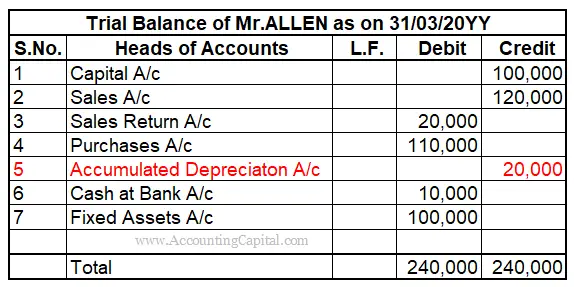

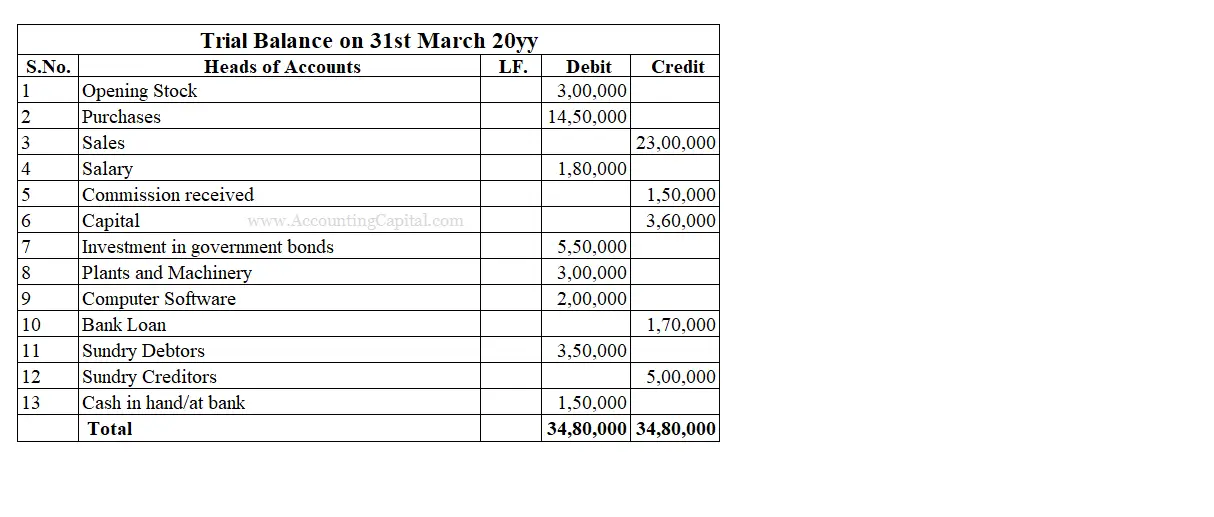

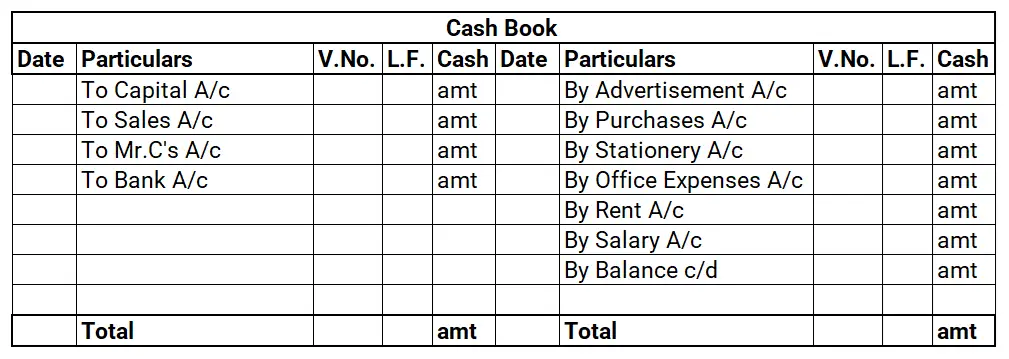

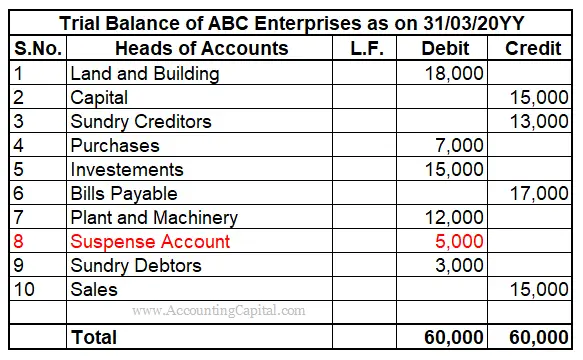

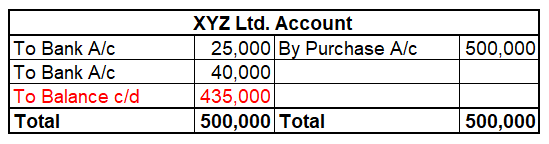

Trial balance is the third step after passing journal entries and posting in ledgers. The trial balance is the summary of all the accounts based on the ledger balance. It is an account prepared to check the athematic accuracy of the debit and credit balances are equal and accurate.

Steps to Prepare Balance Sheet from Trial Balance

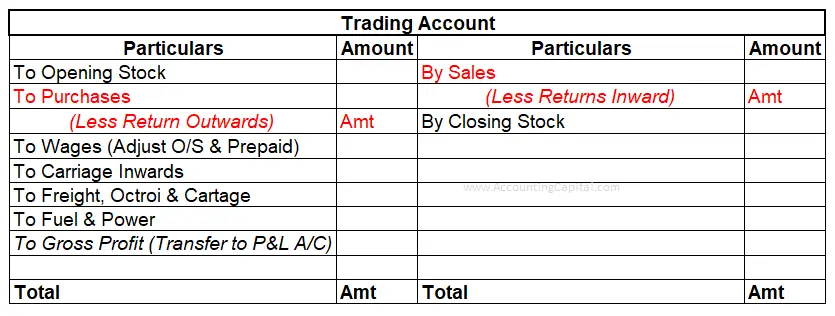

All the debit side items related to assets listed in the trial balance shall be posted on the assets side of the balance sheet. All the credit side items related to capital and liabilities listed in the trial balance shall be posted on the liabilities side of the balance sheet.

1. Post the amount of capital on the liabilities side of the balance sheet under the head “capital & reserves”.

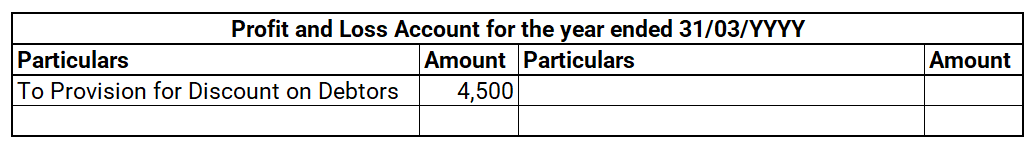

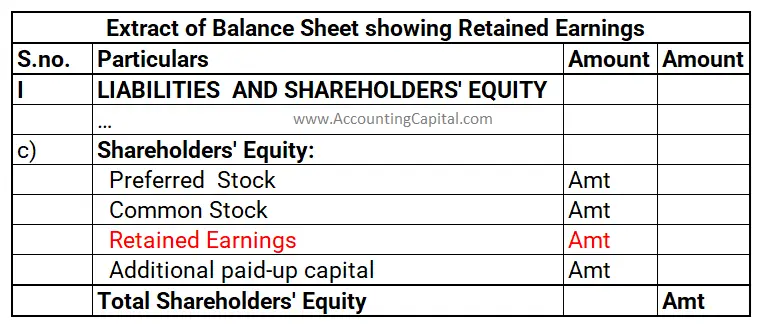

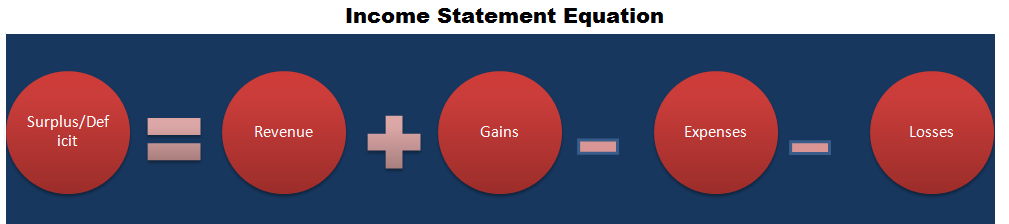

2. Then, the net profit or net loss ascertained while preparing the income statement shall be added or reduced respectively from the amount of capital.

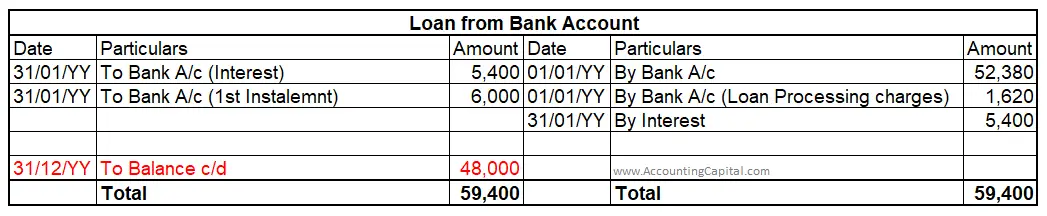

3. Now, post all the “non-current liabilities” such as long-term bank loans, long-term debentures issued, etc. on the balance sheet’s liabilities side.

4. Then, post the “current liabilities” such as sundry creditors, bills payable, etc. Incorporate necessary adjustments related to outstanding expenses and pre-received income.

5. Moving to the asset side, start with the head “non-current assets”.

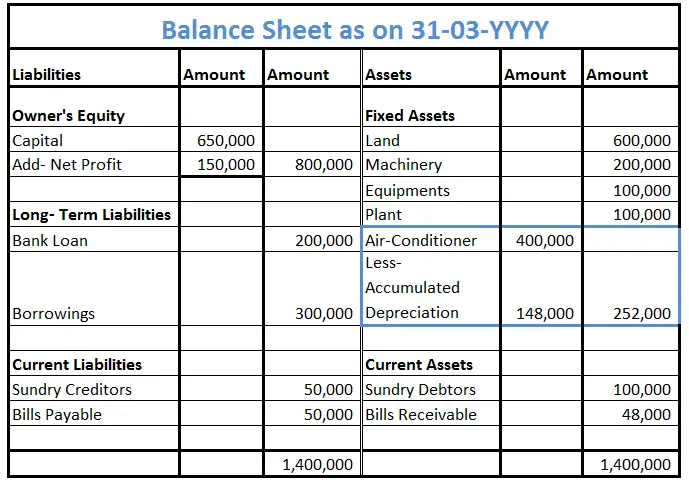

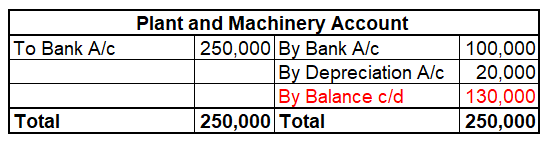

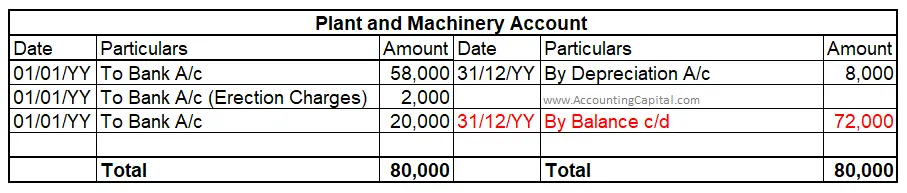

6. First, post the tangible assets under the head “non-current assets” such as plant & machinery, land & building, etc. Calculate depreciation/accumulated depreciation on the tangible assets and deduct the same to arrive at the net value.

7. Second, post the intangible assets under the head “non-current assets” such as software, goodwill, etc. Calculate amortization/accumulated amortization on the intangible assets and deduct the same to arrive at the net value.

8. Now, post all the long-term investments acquired such as bonds and debentures under the head “non-current assets”.

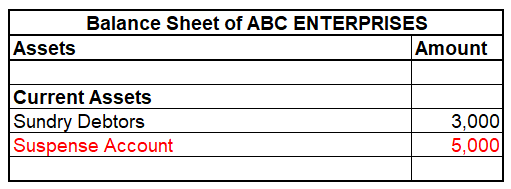

9. After posting all the non-current assets move forward to posting the “current assets” on the asset side of the balance sheet,

10. Post “current assets” such as cash in hand, cash at the bank, sundry debtors, bills receivable, etc. Incorporate necessary adjustments related to provisions for doubtful debts, prepaid expenses, and outstanding income,

11. Post the amount of closing stock given in the adjustments under the head “current assets”.

12. The final step is totaling both the liability and asset sides. Both sides of the balance sheet should be of an equal amount.

These steps complete the preparation of the balance sheet from the trial balance.

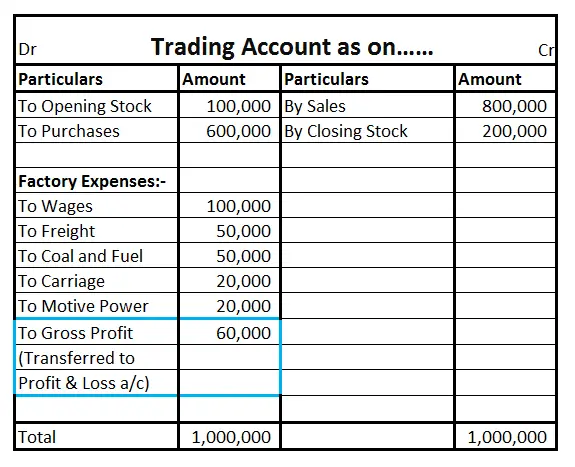

Illustration

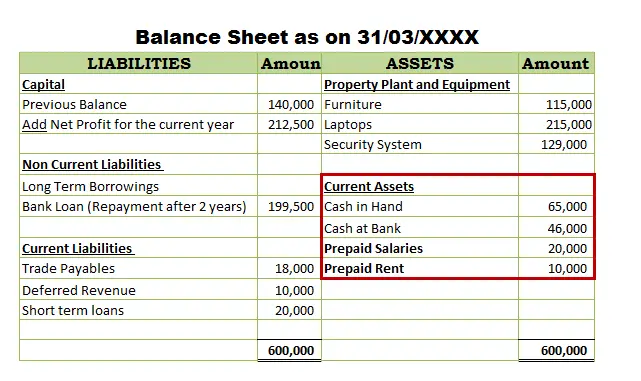

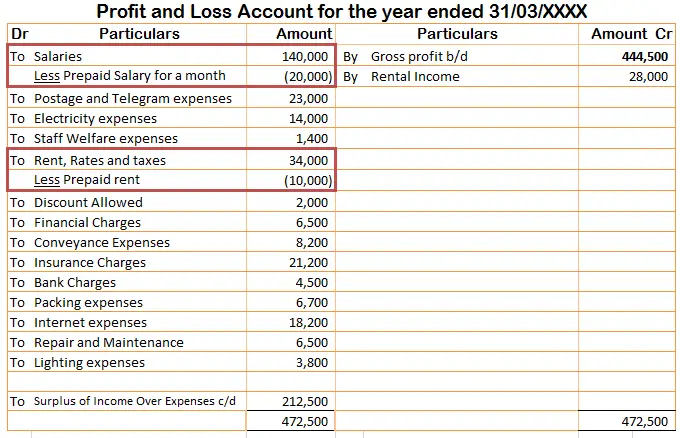

A snippet of the trial balance and balance sheet has been attached for better understanding.

Adjustments

- Closing stock as on 31st March yyyy is 2,00,000.

- The salary outstanding for March yyyy is 60,000.

- Depreciation @10% to be charged on Plant and machinery.

- Amortization @10% charged on computer software.

Prepare a Balance Sheet from the above-given trial balance. Net Profit for the year ended 31/03/YYYY is 610,000.

Conclusion

- It is important to record the balances of ledger posts of different accounts in the trial balance since it helps the company know if their postings are right or wrong when there is a match or mismatch in the debit or credit side of the trial balance.

- The trial balance is later used to make the balance sheet, which is the most important financial statement as it determines the business’s financial position.

- All the credit sides of the trial balance are treated as liabilities and posted in the balance sheet based on the headings such as debt and equity, reserves and surplus, long-term borrowings, short-term borrowing, and current liabilities.

- All the debit side of the trial balance is treated as assets and posted on the asset side of the balance sheet based on the heading like tangible, intangible assets, current assets etc.

The prepaid expenses are reduced from the expenses in the profit and loss account as it is being utilized during the operating year and it slowly reduces the value of the current asset.

The prepaid expenses are reduced from the expenses in the profit and loss account as it is being utilized during the operating year and it slowly reduces the value of the current asset.