In today’s financial landscape, mutual fund AMCs are coming up with various kinds of schemes to meet investors’ financial goals. However, there’s always a roadblock in investors’ minds – too many schemes which one to choose? This is mostly because of lack of awareness. For instance, a lot of beginner investors don’t know the difference between sectoral and index funds.

Here in this blog, we will walk you through a comparison between sectoral funds vs index funds, while highlighting their key differences, benefits and much more. Read along to get further insights about the same.

What Is a Sectoral Fund?

A sectoral mutual fund is a mutual fund type which primarily follows a particular sector and invests in some of the biggest or well-performing companies in that sector. Such funds usually come with a high to very high-risk factor associated with it. The sectoral fund invests 80% of its assets under management in equity or equity-related instruments from that sector, as mandated by SEBI.

If that sector performs poorly, all the companies will follow the same trend and so will the fund’s performance. Such funds can also perform exceptionally well if the sector is booming. If not, it still has a chance of generating higher returns as the fund manager remains confined within a particular sector and might figure out high-growth stock within that sector.

By the way, just to keep you informed, Groww Mutual Fund, previously known as Indiabulls Mutual Fund, is launching a sectoral fund – Groww Banking & Financial Services Fund. This open-ended equity scheme focuses on investments in sectors related to banking and financial services. The New Fund Offer (NFO) will open on January 17, 2024, and close on January 31, 2024.

What Is an Index Fund?

An index mutual fund primarily invests in a portfolio of stocks that replicates a particular index, such as Sensex or Nifty 50. The main objective of this fund is to match the performance of an index which it tracks, instead of an aim to outperform the market. It is a passively managed fund where the fund manager of the scheme does not actively make stock selections and invests in the same company stocks present in the index.

Apart from the stock selection, the fund manager also replicates the proportion of each stock in the index. In a particular index, each stock has a weightage demonstrated in percentage which is treated as proportion in index funds.

Some of the widely known index fund examples include ICICI Prudential Nifty 50 Index Fund, HDFC Index S&P BSE Sensex, Groww Nifty Total Market Index Fund etc.

What Are the Key Features of a Sectoral Fund?

Here are some of the key features of sectoral fund:

- High Risk: As its portfolio remains concentrated within a particular sector, therefore a change in the sectoral growth due to any uncertainties can directly impact your returns.

- Concentrated Portfolio: The portfolio of a sectoral fund remains concentrated within a particular sector or industry. For instance, a banking sector fund will have stocks like HDFC Bank, ICICI Bank, SBI etc.

- Higher Returns: If sectoral growth can be predicted correctly then a sectoral fund can help you generate higher returns over time.

- Taxation: Short-term capital gains are taxed at a rate of 15% and long-term capital gains of above Rs.1 lakh are taxed at 10% (LTCG below Rs.1 lakh is exempted from tax).

What Are the Key Features of Index Funds?

Here are some of the key features of index fund:

- Lower Expense Ratio: As index funds are passively managed, the expense ratio charged by the fund is lower compared to actively managed funds.

- Diversified Portfolio: Index funds track an underlying index, which houses stocks across sectors. For example, the Nifty Total Market Index tracks 750+ companies across multiple sectors. Hence, even if one sector is poorly performing it can be compensated by the one performing well.

- Free from Judgement Errors: Since index funds replicate the performance of the underlying index, they are free from judgement errors or human biases.

Index Funds vs Sectoral Funds: Key Difference

Here are some of the key differences between sectoral and index funds:

- Risk Factor

The risk factors associated with index funds are typically low and considered one of the less risky equity fund types. This is primarily due to their diversified nature, encompassing various types of stocks across different sectors. As a result, a downward trend in a particular sector can be compensated by an uptrend in another.

On the other hand, a sectoral fund comes with a comparatively higher risk factor as all the stocks in the portfolio are concentrated within a particular sector. If that sector underperforms, it will directly impact investments. This type of fund is largely impacted by factors such as an amendment in government policies or a change in tax regulation.

For instance, a few months back the smart gadget manufacturing industry (electronics and IT sector) was facing tough challenges due to a global shortage of semiconductor chipsets.

- Performance

Index funds are structured to closely replicate the overall market performance, as they consist of top-performing companies that may change over time. This dynamic composition allows index funds to track the general economic conditions and perform based on the current economic scenario of the country.

A sectoral fund can do well if the area they focus on grows at an exponential rate or if the fund manager makes a smart move. However, these funds can also do worse if that specific sector underperforms or if the manager ends up not making a good stock selection.

- Investment Strategy

Index funds track a particular index and replicate the portfolio of stocks to match the performance of that particular index such as Nifty 50, Sensex, Nifty Bank etc.

On the other hand, a sectoral fund primarily invests in companies in a particular sector such as Pharma, Banking, IT etc. The portfolio of the fund is concentrated within that sector and aims to generate exponential returns leveraging sectoral growth.

Sectoral Funds vs Index Funds: Which One Is Better?

The right choice between sectoral and index funds entirely depends on the investment goals, time horizon, and risk tolerance of the investor.

If one is a risk-averse investor and looking forward to taking some exposure in equity with an objective of long-term growth and stability, then surely index funds can be a perfect investment choice for you.

If one has a high-risk tolerance and is looking forward to making exponential gains and at the same time must have high conviction on a particular sector, then a sectoral fund can be a wise move to leverage the growth of the booming sector.

The Bottom Line

To make an informed investment decision, it is in your best interest to carefully consider all the key differences between sectoral funds vs index funds. Regardless of your choice, you must ensure that the investment strategy associated with your decision aligns with your financial objectives.

Related Topic –

Related Topic –

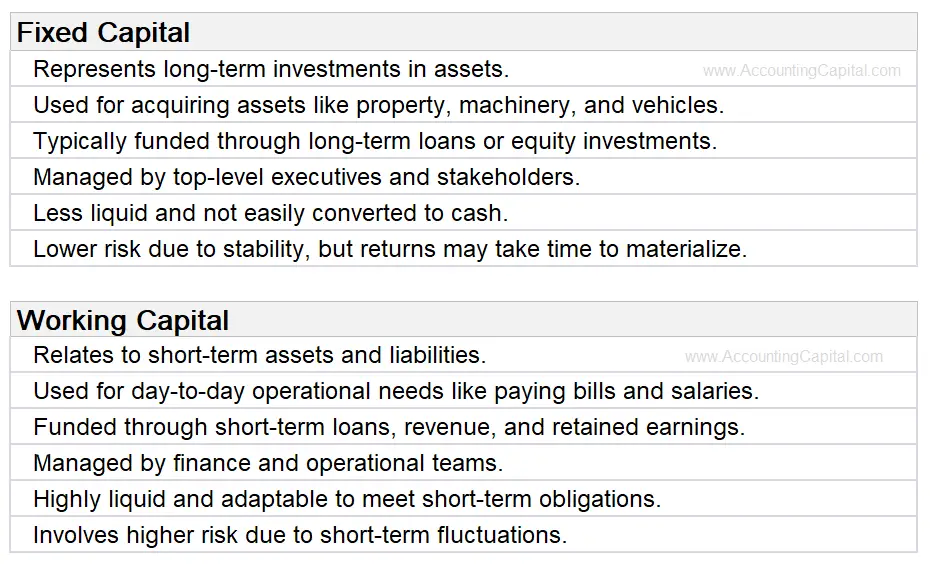

Both fixed and working capital are of equal importance for the existence and smooth functioning of the entity. Identifying the right source and amount of both fixed and working capital is a strategic task for an entity.

Both fixed and working capital are of equal importance for the existence and smooth functioning of the entity. Identifying the right source and amount of both fixed and working capital is a strategic task for an entity.